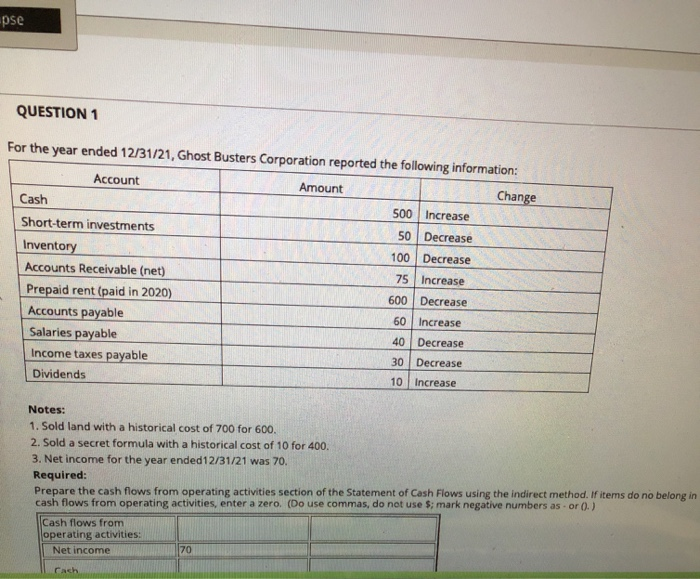

Question: pse QUESTION 1 For the year ended 12/31/21, Ghost Busters Corporation reported the following information: Account Amount Change Cash 500 Increase Short-term investments 50 Decrease

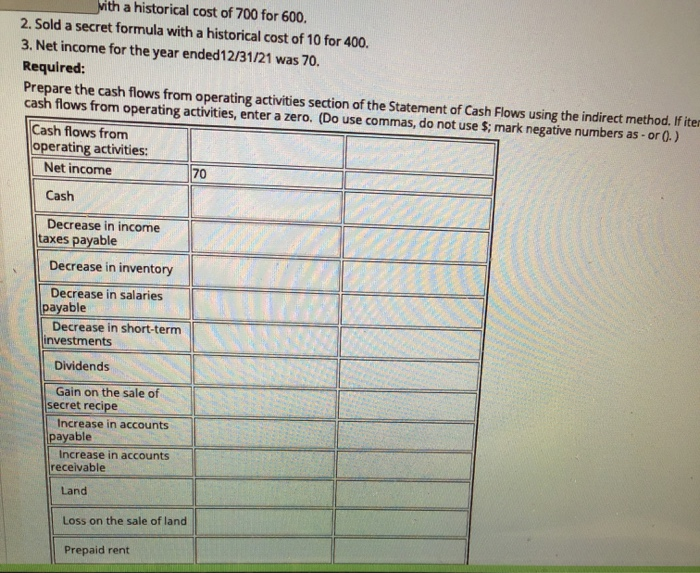

pse QUESTION 1 For the year ended 12/31/21, Ghost Busters Corporation reported the following information: Account Amount Change Cash 500 Increase Short-term investments 50 Decrease Inventory 100 Decrease Accounts Receivable (net) 75 Increase Prepaid rent (paid in 2020) 600 Decrease Accounts payable 60 Increase Salaries payable 40 Decrease Income taxes payable 30 Decrease Dividends 10 Increase Notes: 1. Sold land with a historical cost of 700 for 600. 2. Sold a secret formula with a historical cost of 10 for 400. 3. Net income for the year ended 12/31/21 was 70. Required: Prepare the cash flows from operating activities section of the Statement of Cash Flows using the indirect method. If items do no belong in cash flows from operating activities, enter a zero. (Do use commas, do not use $; mark negative numbers as or 0.) Cash flows from operating activities: Net income 70 with a historical cost of 700 for 600. 2. Sold a secret formula with a historical cost of 10 for 400. 3. Net income for the year ended 12/31/21 was 70. Required: Prepare the cash flows from operating activities section of the Statement of Cash Flows using the indirect method. If iter cash flows from operating activities, enter a zero. (Do use commas, do not use $; mark negative numbers as - or.) Cash flows from operating activities: Net income 70 Cash Decrease in income taxes payable Decrease in inventory Decrease in salaries payable Decrease in short-term investments Dividends Gain on the sale of secret recipe Increase in accounts payable Increase in accounts receivable Land Loss on the sale of land Prepaid rent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts