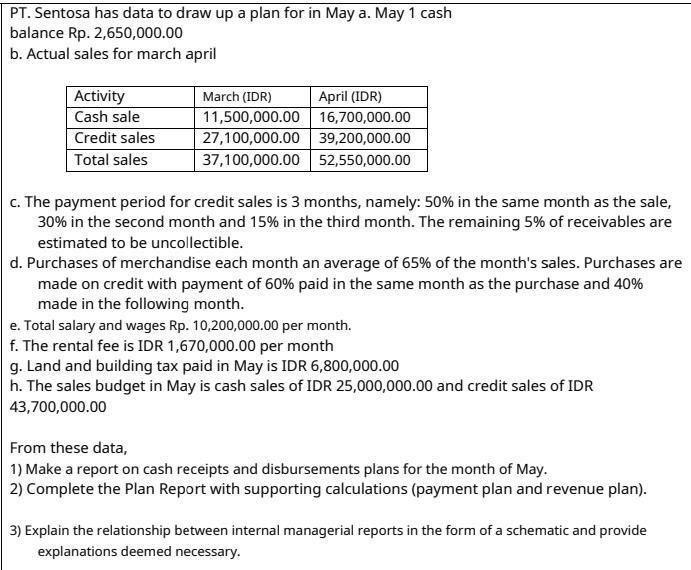

Question: PT. Sentosa has data to draw up a plan for in May a. May 1 cash balance Rp. 2,650,000.00 b. Actual sales for march

PT. Sentosa has data to draw up a plan for in May a. May 1 cash balance Rp. 2,650,000.00 b. Actual sales for march april Activity Cash sale Credit sales Total sales March (IDR) 11,500,000.00 27,100,000.00 39,200,000.00 37,100,000.00 52,550,000.00 April (IDR) 16,700,000.00 c. The payment period for credit sales is 3 months, namely: 50% in the same month as the sale, 30% in the second month and 15% in the third month. The remaining 5% of receivables are estimated to be uncollectible. d. Purchases of merchandise each month an average of 65% of the month's sales. Purchases are made on credit with payment of 60% paid in the same month as the purchase and 40% made in the following month. e. Total salary and wages Rp. 10,200,000.00 per month. f. The rental fee is IDR 1,670,000.00 per month g. Land and building tax paid in May is IDR 6,800,000.00 h. The sales budget in May is cash sales of IDR 25,000,000.00 and credit sales of IDR 43,700,000.00 From these data, 1) Make a report on cash receipts and disbursements plans for the month of May. 2) Complete the Plan Report with supporting calculations (payment plan and revenue plan). 3) Explain the relationship between internal managerial reports in the form of a schematic and provide explanations deemed necessary.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

1 Cash Receipts and Disbursements Plan for May Cash Receipts a Beginning Cash Balance Rp 265000000 b Cash Sales Rp 2500000000 c Credit Sales Rp 105000... View full answer

Get step-by-step solutions from verified subject matter experts