Question: pter 22 arning Objective E2-30 Preparing t FG inventory $3,15o Bake, Inc has the following balance sheet at December 31, 2018 E22-31 the financial budget-budgeted

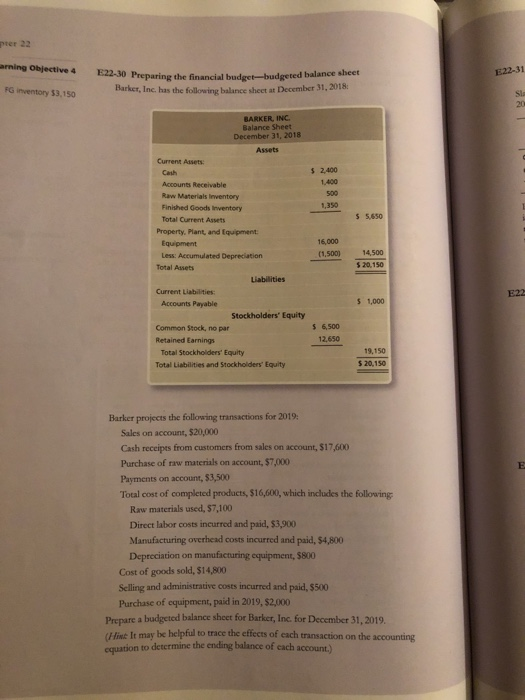

pter 22 arning Objective E2-30 Preparing t FG inventory $3,15o Bake, Inc has the following balance sheet at December 31, 2018 E22-31 the financial budget-budgeted balance sheet Sla BARKER, INC. Balance Sheet December 31, 2018 Assets Current Adsets s 2,400 1,400 500 1,350 Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets _s 5,650 Property, Plant, and Equipment 16,000 (1.500 14500 20,150 Liabilities Current Liabilities: E22 s 1,000 Accounts Payable Stockholders' Equity 6,500 12,650 Common Stock, no par Retained Earnings 19,150 s 20,150 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Barker projects the following transactions for 2019 Sales on account, $20,000 Cash receipts from customers from sales on account, $17,600 Purchase of raw materials on account, $7,000 Payments on account, $3,500 Total cost of completed products, $16,600, which includes the following Raw materials used, $7,100 Direct labor costs incurred and paid, $3,900 Manufacturing overhead costs incurred and paid, $4,800 Depreciation on manufacturing equipment, $800 Cost of goods sold, $14,800 Selling and administrative costs incurred and paid, $500 Purchase of equipment, paid in 2019, $2,000 Prepare a budgeted balance shcet for Barker, Inc. for December 31, 2019. lisc It may be helpful to trace the effects of each transaction on the accounting equation to detcrmine the ending balance of each account.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts