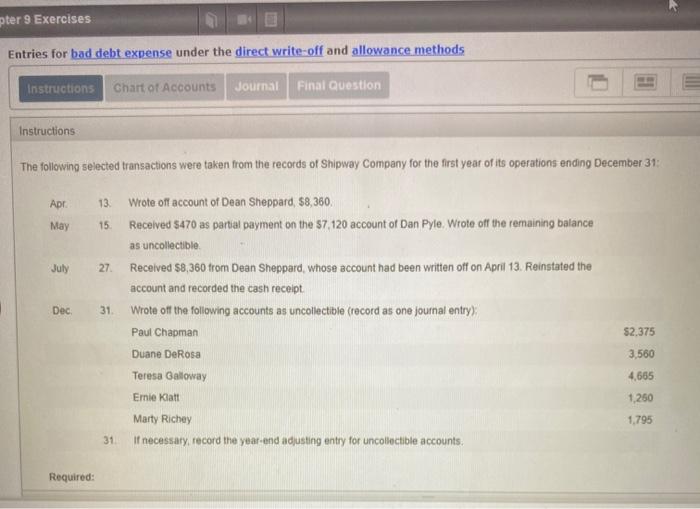

Question: pter 9 Exercises Entries for bad debt expense under the direct write-off and allowance methods Instructions Chart of Accounts Journal Final Question Instructions The following

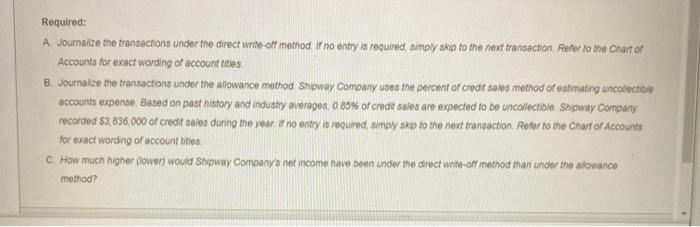

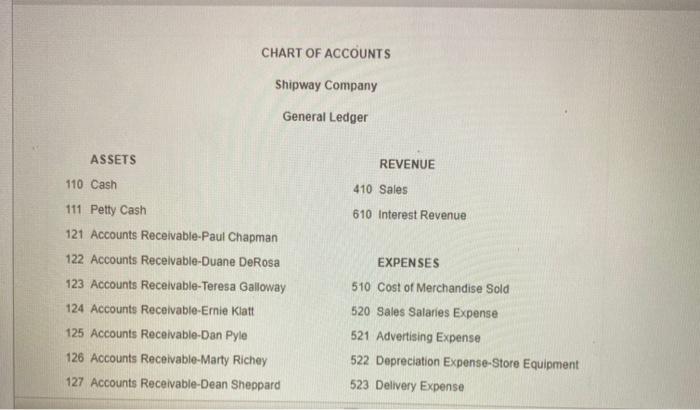

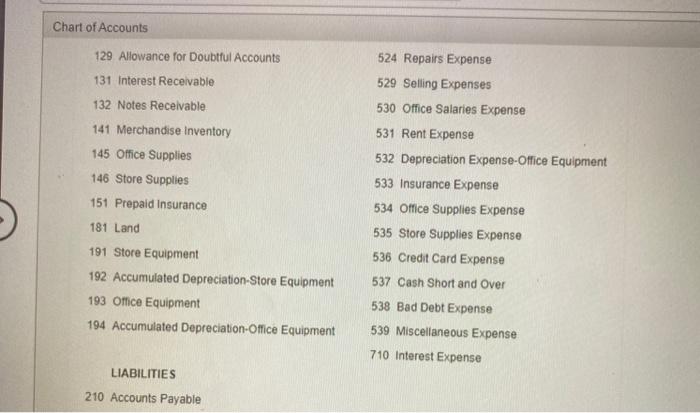

pter 9 Exercises Entries for bad debt expense under the direct write-off and allowance methods Instructions Chart of Accounts Journal Final Question Instructions The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31: Apr May July 13 Wrote off account of Dean Sheppard, $8,360. 15 Received $470 as partial payment on the 57.120 account of Dan Pyle Wrote off the remaining balance as uncollectible 27 Received $8,360 from Dean Sheppard, whose account had been written off on April 13. Reinstated the account and recorded the cash receipt. 31 Wrote of the following accounts as uncollectible (record as one journal entry) Paul Chapman Duane Derosa Teresa Galloway Dec $2.375 3.560 4,665 Emie kalt 1.250 1.795 Marty Richey If necessary, record the year-end adjusting entry for uncollectible accounts 31 Required: Required: A Journalize the transactions under the direct write-off method i no entry is required, simply skip to the next transaction Refer to the Chart of Accounts for exact wording of account titles B. Journalize the transactions under the allowance method Showay Company uses the percent of credit sales method of estimating uncollection accounts expense. Based on past history and industry averages 0 89% of credit sales are expected to be uncollection Shipway Company recorded 59,836,000 of credit sales during the year i no entry is required simply skip to the next transaction. Refer to the chart of Accounts for exact wording of account titles C. How much higher (lower) would showay Company's net income nave been under the direct white-off method than under the allowance method? CHART OF ACCOUNTS Shipway Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue 111 Petty Cash 121 Accounts Receivable-Paul Chapman 122 Accounts Receivable-Duane DeRosa 123 Accounts Receivable-Teresa Galloway 124 Accounts Receivable-Ernie Klatt 125 Accounts Receivable-Dan Pyle 126 Accounts Receivable-Marty Richey 127 Accounts Receivable-Dean Sheppard EXPENSES 510 Cost of Merchandise Sold 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense Chart of Accounts 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 524 Repairs Expense 529 Selling Expenses 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense 181 Land 191 Store Equipment 192 Accumulated Depreciation Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment LIABILITIES 210 Accounts Payable 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary eBook Show Me How Printer A Jumano ne transactions under the director method to try required my trip to me next transachon Refer to the Chart of Accounts for recording of contos JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POSTRE CREDIT ACTS LABUTES LUTY 18 11 12 14 Chapter 9 Exercises ebook throw Me How Potem mezone transactions were to thway Comory word method of coccount Based on paratory and use 0. of credit as are cted to be corecte Showay Company recorded 58% of credt samtavo you Woody a retured amoy ko to no artachon mal ist chur ar Accounts for ret wong of accounts JOU ACCOUNTING EQUATION bio PO UE dury Final Question C. How much higher power) would Showay Company's net income have been under the direct write-ot method than under the allowance method? by's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts