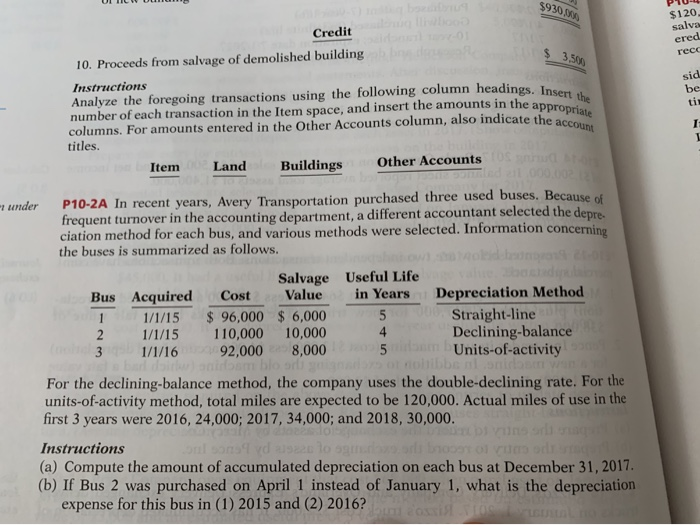

Question: PU- $930.000 $120 salva ered rece $ 3,500 sid be Credit 10. Proceeds from salvage of demolished building Instructions Analyze the foregoing transactions using the

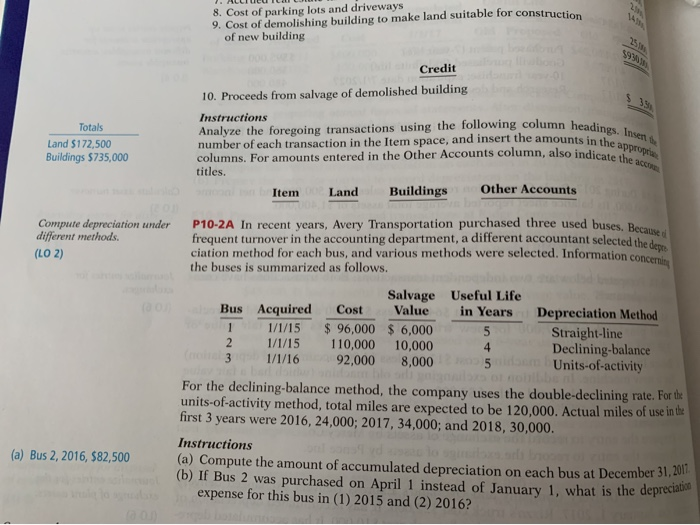

PU- $930.000 $120 salva ered rece $ 3,500 sid be Credit 10. Proceeds from salvage of demolished building Instructions Analyze the foregoing transactions using the following column headings. In number of each transaction in the Item space, and insert the amounts in the appr columns. For amounts entered in the Other Accounts column, also indicate the ad titles. Item Land Buildings Other Accounts dings. Insert the in the appropriate indicate the account - under P10-2A In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depre. ciation method for each bus, and various methods were selected. Information concerning the buses is summarized as follows. Bus Acquired 1 1/1/15 2 1/1/15 1/1/16 Cost $ 96,000 110,000 9 2,000 Salvage Useful Life Value in Years $ 6,000 5 10,000 8,000 5 Depreciation Method Straight-line Declining-balance Units-of-activity 3 For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 120,000. Actual miles of use in the first 3 years were 2016, 24,000; 2017, 34,000; and 2018, 30,000. Instructions non vd 2 to g o to (a) Compute the amount of accumulated depreciation on each bus at December 31, 2017. (b) If Bus 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2015 and (2) 2016? 8. Cost of parking lots and driveways 9. Cost of demolishing building to make land suitable for construction of new building $33 Totals Land $172,500 Buildings $735,000 Credit 10. Proceeds from salvage of demolished building Instructions Analyze the foregoing transactions using the following column headin number of each transaction in the Item space, and insert the amounts in the columns. For amounts entered in the Other Accounts column, also indicat titles. Item Land Buildings Other Accounts headings. Insente is in the appropria indicate the acco Compute depreciation under different methods. (LO 2) selected the depo P10-2A In recent years, Avery Transportation purchased three used buses. R. frequent turnover in the accounting department, a different accountant selected ciation method for each bus, and arious methods were selected. Information con the buses is summarized as follows. Salvage Useful Life Bus Acquired Cost Value in Years Depreciation Method 1 1/1/15 $ 96,000 $ 6,000 5 Straight-line 2 1/1/15 110,000 10,000 Declining-balance 3 1/1/16 92,000 8,000 5 Units-of-activity For the declining balance method, the company uses the double-declining rate. For units-of-activity method, total miles are expected to be 120,000. Actual miles of use in first 3 years were 2016, 24,000; 2017, 34,000; and 2018, 30,000. Instructions (a) Compute the amount of accumulated depreciation on each bus at December 31 (b) If Bus 2 was purchased on April 1 instead of January 1. what is the depre expense for this bus in (1) 2015 and (2) 2016? (a) Bus 2, 2016, $82,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts