Question: PUB is installing a new pump for a critical drainage system to prevent flash flooding during heavy storms. Relevant data for three alternative systems being

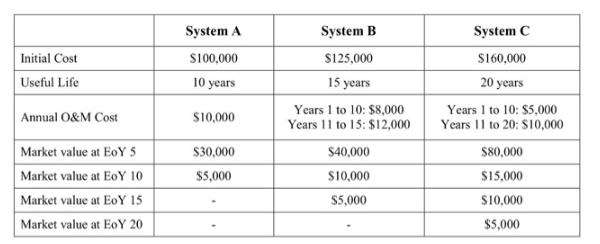

PUB is installing a new pump for a critical drainage system to prevent flash flooding during heavy storms. Relevant data for three alternative systems being considered are given below:

MARR for this project is 5%.

(a) If the study period is 10 years, determine which alternative should be chosen using any Discounted Cash Flow methods. State the main assumptions made.

(b) If the study period is 10 years, determine which alternative should be chosen using the IRR method. You may use any equation solver to compute IRRs after stating the relevant equations that need to be solved.

(c) If the study period is 15 years, determine which alternative should be chosen using any discounted cash flow methods. State the main assumptions made.

(d) If the study period is infinity, determine which alternative should be chosen. State the main assumptions made.

Initial Cost Useful Life Annual O&M Cost Market value at EOY 5 Market value at EoY 10 Market value at EoY 15 Market value at EoY 20 System A $100,000 10 years $10,000 $30,000 $5,000 System B $125,000 15 years Years 1 to 10: $8,000 Years 11 to 15: $12,000 $40,000 $10,000 $5,000 System C $160,000 20 years Years 1 to 10: $5,000 Years 11 to 20: $10,000 $80,000 $15,000 $10,000 $5,000

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

To determine which system should be chosen we will evaluate the alternatives using discounted cash flow DCF and internal rate of return IRR methods He... View full answer

Get step-by-step solutions from verified subject matter experts