Question: Published account i only want to know t he statement of profit or loss for questions 1 RM QUESTION 1 Brilliant Bhd is an experienced

Published account

i only want to know the statement of profit or loss for questions 1

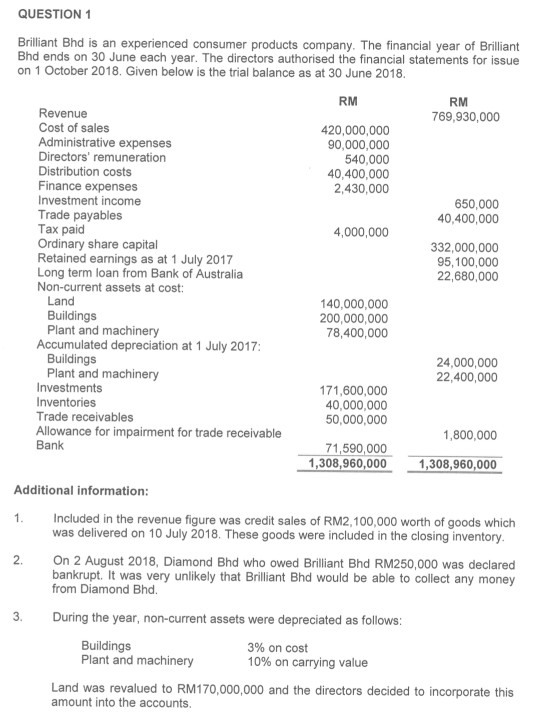

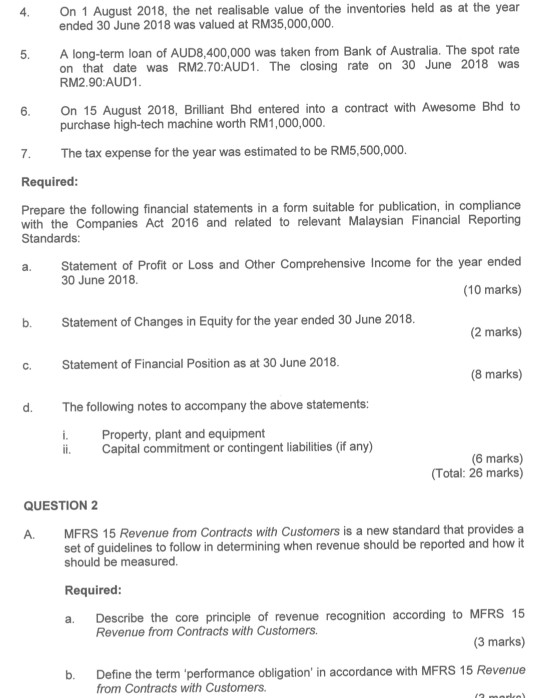

RM QUESTION 1 Brilliant Bhd is an experienced consumer products company. The financial year of Brilliant Bhd ends on 30 June each year. The directors authorised the financial statements for issue on 1 October 2018. Given below is the trial balance as at 30 June 2018. RM Revenue 769,930,000 Cost of sales 420,000,000 Administrative expenses 90,000,000 Directors' remuneration 540,000 Distribution costs 40,400,000 Finance expenses 2,430,000 Investment income 650,000 Trade payables 40,400,000 Tax paid 4,000,000 Ordinary share capital 332,000,000 Retained earnings as at 1 July 2017 95,100,000 Long term loan from Bank of Australia 22,680,000 Non-current assets at cost: Land 140,000,000 Buildings 200,000,000 Plant and machinery 78,400,000 Accumulated depreciation at 1 July 2017 Buildings 24,000,000 Plant and machinery 22,400,000 Investments 171,600,000 Inventories 40,000,000 Trade receivables 50,000,000 Allowance for impairment for trade receivable 1,800,000 Bank 71,590,000 1,308,960,000 1,308,960,000 Additional information: Included in the revenue figure was credit sales of RM2,100,000 worth of goods which was delivered on 10 July 2018. These goods were included in the closing inventory. 2. On 2 August 2018, Diamond Bhd who owed Brilliant Bhd RM250,000 was declared bankrupt. It was very unlikely that Brilliant Bhd would be able to collect any money from Diamond Bhd. 3 During the year, non-current assets were depreciated as follows: Buildings 3% on cost Plant and machinery 10% on carrying value Land was revalued to RM170,000,000 and the directors decided to incorporate this amount into the accounts. 1. 4. 6. a. On 1 August 2018, the net realisable value of the inventories held as at the year ended 30 June 2018 was valued at RM35,000,000 5. A long-term loan of AUD8,400,000 was taken from Bank of Australia. The spot rate on that date was RM2.70:AUD1. The closing rate on 30 June 2018 was RM2.90:AUD1 On 15 August 2018, Brilliant Bhd entered into a contract with Awesome Bhd to purchase high-tech machine worth RM1,000,000. 7. The tax expense for the year was estimated to be RM5,500,000 Required: Prepare the following financial statements in a form suitable for publication, in compliance with the Companies Act 2016 and related to relevant Malaysian Financial Reporting Standards: Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2018 (10 marks) b. Statement of Changes in Equity for the year ended 30 June 2018. (2 marks) Statement of Financial Position as at 30 June 2018. (8 marks) The following notes to accompany the above statements: Property, plant and equipment ii. Capital commitment or contingent liabilities (if any) (6 marks) (Total: 26 marks) QUESTION 2 A MFRS 15 Revenue from Contracts with Customers is a new standard that provides a set of guidelines to follow in determining when revenue should be reported and how it should be measured. c. d. i. Required: a. Describe the core principle of revenue recognition according to MFRS 15 Revenue from Contracts with Customers. (3 marks) b. Define the term 'performance obligation' in accordance with MFRS 15 Revenue from Contracts with Customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts