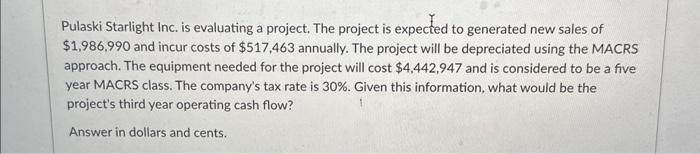

Question: Pulaski Starlight Inc. is evaluating a project. The project is expected to generated new sales of ( $ 1,986,990 ) and incur costs of (

Pulaski Starlight Inc. is evaluating a project. The project is expected to generated new sales of \\( \\$ 1,986,990 \\) and incur costs of \\( \\$ 517,463 \\) annually. The project will be depreciated using the MACRS approach. The equipment needed for the project will cost \\( \\$ 4,442,947 \\) and is considered to be a five year MACRS class. The company's tax rate is \30. Given this information, what would be the project's third year operating cash flow? Answer in dollars and cents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts