Question: Purchase Discounts (Gross vs. Net Methods) sample: Otto Carp purchased merchandise during 2014 on credit for $400,000 (2/10, 30). All of the Wann ennep 80,000

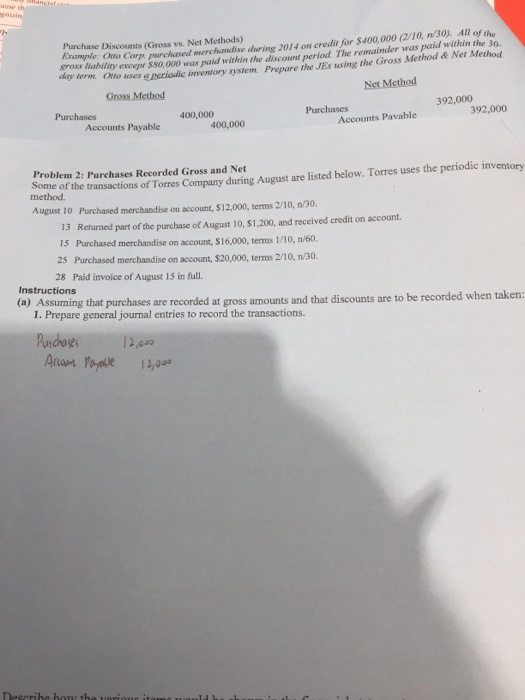

Purchase Discounts (Gross vs. Net Methods) sample: Otto Carp purchased merchandise during 2014 on credit for $400,000 (2/10, 30). All of the Wann ennep 80,000 was paid within the discount period. The remainder was paid when the 30 de Oro uses a periodic inventory system Prepare the JAS sing the Gross Method de Ner Method Net Method Gross Method 392,000 392,000 Purchases Accounts Payable Purchases Accounts Pavable 400,000 400,000 Problem 2: Purchases Recorded Gross and Net Some of the transactions of Torres Company during August are listed below. Torres uses the periodic inventory method. August 10 Purchased merchandise on account, $12,000, terms 2/10, n/30. 13 Returned part of the purchase of August 10, $1,200, and received credit on account. 15 Purchased merchandise on account, $16,000, terms 1/10, 1/60 25 Purchased merchandise on account, $20,000, terms 2/10, 1/30. 28 Paid invoice of August 15 in full. Instructions (a) Assuming that purchases are recorded at gross amounts and that discounts are to be recorded when taken: 1. Prepare general journal entries to record the transactions. Purchases Allan Payable 12,0-0 12,000 Describe how the orient l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts