Question: Please provide General Journal entries below. Cheque Purchase Invoice #PFU-4877 From Places For Us, $1 800 plus $234 HST for monthly rent. Invoice total $2

Please provide General Journal entries below.

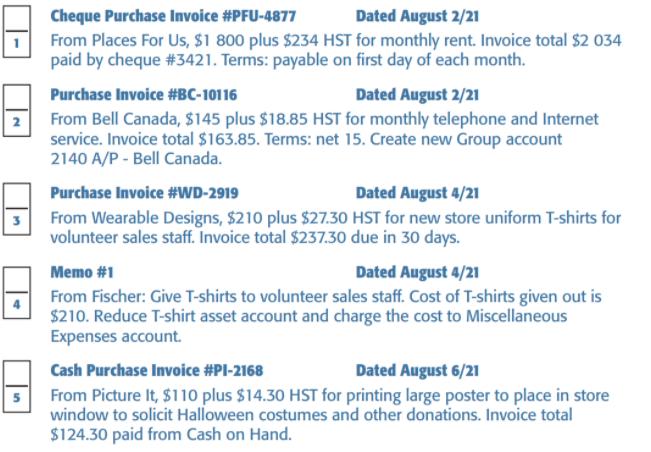

Cheque Purchase Invoice #PFU-4877 From Places For Us, $1 800 plus $234 HST for monthly rent. Invoice total $2 034 paid by cheque #3421. Terms: payable on first day of each month. Dated August 2/21 Purchase Invoice #BC-10116 Dated August 2/21 From Bell Canada, $145 plus $18.85 HST for monthly telephone and Internet service. Invoice total $163.85. Terms: net 15. Create new Group account 2140 A/P - Bell Canada. Purchase Invoice #WD-2919 Dated August 4/21 From Wearable Designs, $210 plus $27.30 HST for new store uniform T-shirts for volunteer sales staff. Invoice total $237.30 due in 30 days. Memo #1 Dated August 4/21 From Fischer: Give T-shirts to volunteer sales staff. Cost of T-shirts given out is $210. Reduce T-shirt asset account and charge the cost to Miscellaneous Expenses account. Cash Purchase Invoice #PI-2168 Dated August 6/21 From Picture It, $110 plus $14.30 HST for printing large poster to place in store window to solicit Halloween costumes and other donations. Invoice total $124.30 paid from Cash on Hand.

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Solution Solution Required General Journal Date Account Titles Debit Credit ... View full answer

Get step-by-step solutions from verified subject matter experts