Question: Purchase Security Date Atlanta Corp., 5% Oct. 1, Year 1 Dallas Inc. bonds, 4% Jul. 1. Year 1 Entries and FS Presentation for Year 1

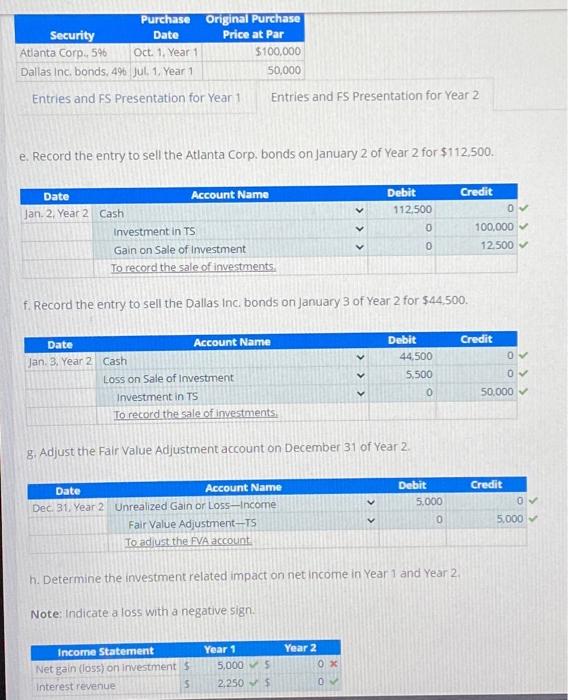

Purchase Security Date Atlanta Corp., 5% Oct. 1, Year 1 Dallas Inc. bonds, 4% Jul. 1. Year 1 Entries and FS Presentation for Year 1 Date Jan. 2, Year 2 Cash Original Purchase Price at Par $100,000 50,000 e. Record the entry to sell the Atlanta Corp. bonds on January 2 of Year 2 for $112,500. Date Jan. 3, Year 2 Account Name Investment in TS Gain on Sale of Investment To record the sale of investments. Account Name Cash Loss on Sale of Investment f. Record the entry to sell the Dallas Inc. bonds on January 3 of Year 2 for $44,500. Investment in TS To record the sale of investments. Entries and FS Presentation for Year 2 Income Statement Net gain (loss) on investment $ Interest revenue $ Date Account Name Dec. 31, Year 2 Unrealized Gain or Loss-Income Fair Value Adjustment-TS To adjust the FVA account. Note: Indicate a loss with a negative sign. g. Adjust the Fair Value Adjustment account on December 31 of Year 2. Year 1 5,000 2,250 $ $ Debit 112,500 Year 2 h. Determine the investment related impact on net income in Year 1 and Year 2. 0x 0 Debit 0 0 44,500 5,500 0 Debit 5.000 0 Credit 100,000 12,500 Credit 0 V Credit 0 0 50,000 0 5,000

Entries and FS Presentation for Year 2 e. Record the entry to sell the Atlanta Corp. bonds on January 2 of Year 2 for $112,500. f. Record the entry to sell the Dallas Inc. bonds on January 3 of Year 2 for $44,500. g. Adjust the Fair Value Adjustment account on December 31 of Vear 2. h. Determine the investment related impact on net income in Year 1 and Year 2. Note: Indicate a loss with a negative sign

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock