Question: Purchasing Power Parity Forecasts. Use the table containing economic, financial, and business indicators to answer the following questions. Assuming purchasing power parity, and assuming that

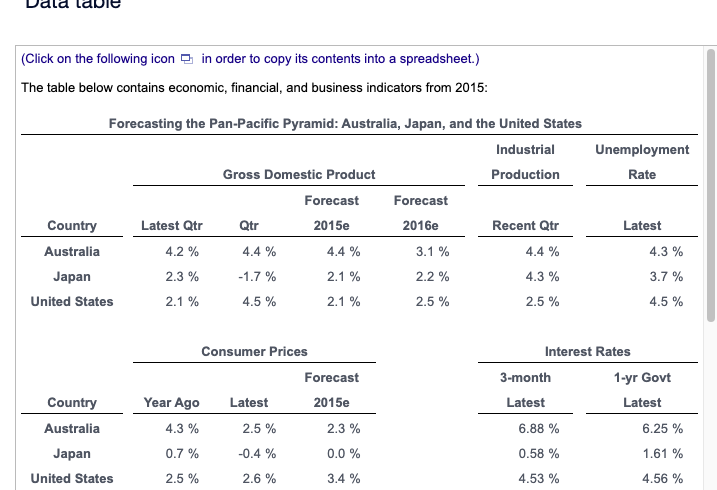

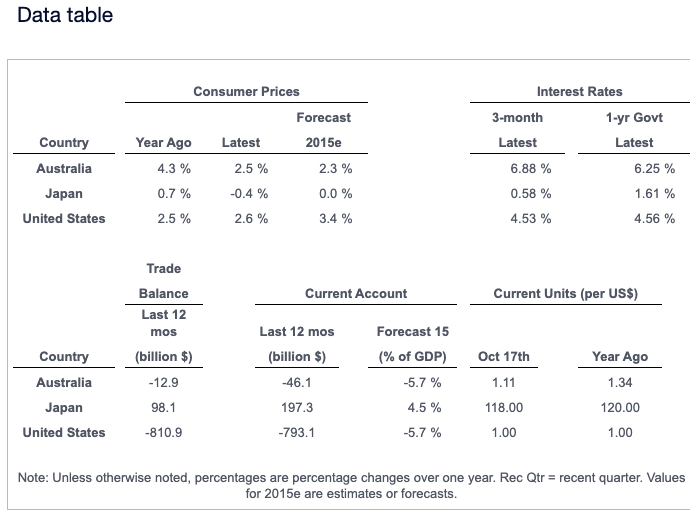

Purchasing Power Parity Forecasts. Use the table containing economic, financial, and business indicators to answer the following questions. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following cross-rates: a. Japanese yen to U.S. dollar in one year b. Japanese yen to Australian dollar in one year c. Australian dollar to U.S. dollar in one year Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates: a. Japanese yen to U.S. dollar in one year The forecast of the spot rate for Japanese yen/U.S. dollar in one year is 1\$. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) The table below contains economic, financial, and business indicators from 2015: Data table Note: uniess otnerwise notea, percentages are percentage cnanges over one year. Kec Qtr = recent quarter. values for 2015e are estimates or forecasts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts