Question: Purchasing - power parity ( PPP ) theory states that exchange rates would need to equalize the prices of goods in any two countries. For

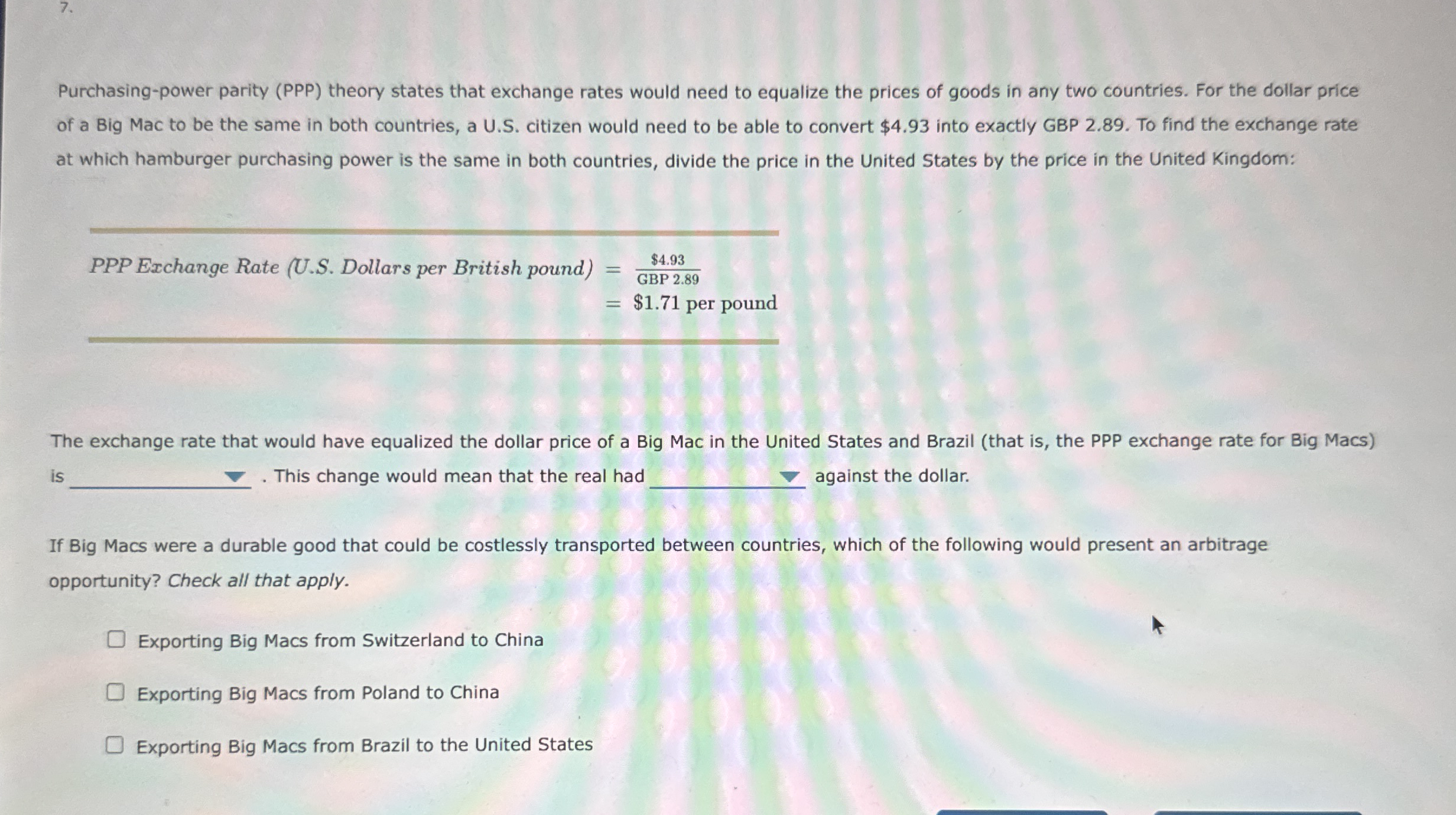

Purchasingpower parity PPP theory states that exchange rates would need to equalize the prices of goods in any two countries. For the dollar price of a Big Mac to be the same in both countries, a US citizen would need to be able to convert $ into exactly GBP To find the exchange rate at which hamburger purchasing power is the same in both countries, divide the price in the United States by the price in the United Kingdom:

Exchange Rate Dollars per British pound

$ per pound

The exchange rate that would have equalized the dollar price of a Big Mac in the United States and Brazil that is the PPP exchange rate for Big Macs is This change would mean that the real had against the dollar.

If Big Macs were a durable good that could be costlessly transported between countries, which of the following would present an arbitrage opportunity? Check all that apply.

Exporting Big Macs from Switzerland to China

Exporting Big Macs from Poland to China

Exporting Big Macs from Brazil to the United States

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock