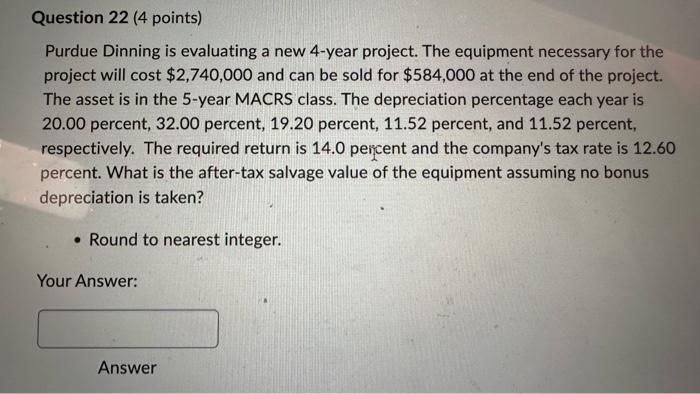

Question: Purdue Dinning is evaluating a new 4-year project. The equipment necessary for the project will cost $2,740,000 and can be sold for $584,000 at the

Purdue Dinning is evaluating a new 4-year project. The equipment necessary for the project will cost $2,740,000 and can be sold for $584,000 at the end of the project. The asset is in the 5-year MACRS class. The depreciation percentage each year is 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent, respectively. The required return is 14.0 peicent and the company's tax rate is 12.60 percent. What is the after-tax salvage value of the equipment assuming no bonus depreciation is taken? - Round to nearest integer. Your Answer: Answer Purdue Dinning is evaluating a new 4-year project. The equipment necessary for the project will cost $2,740,000 and can be sold for $584,000 at the end of the project. The asset is in the 5-year MACRS class. The depreciation percentage each year is 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent, respectively. The required return is 14.0 peicent and the company's tax rate is 12.60 percent. What is the after-tax salvage value of the equipment assuming no bonus depreciation is taken? - Round to nearest integer. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts