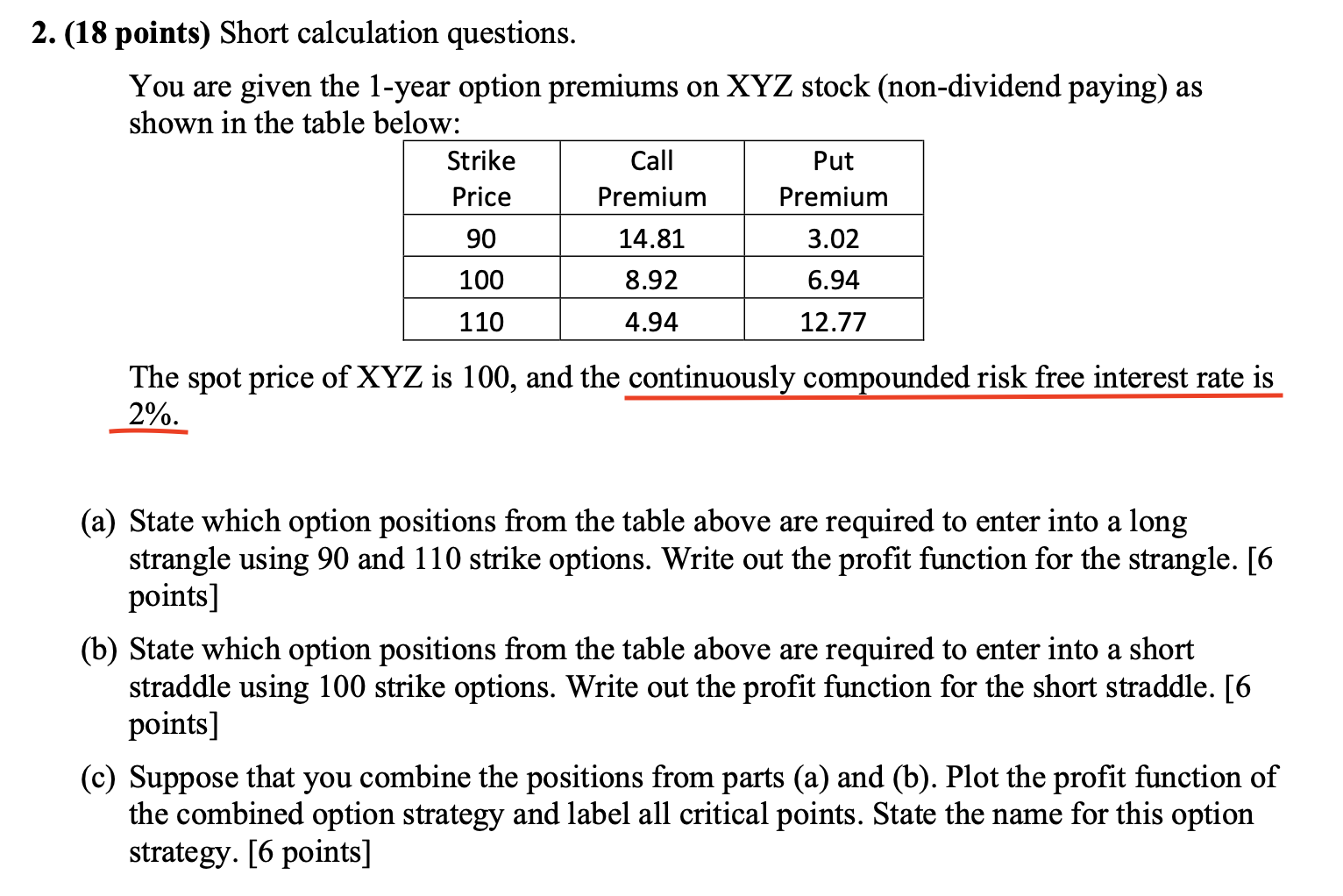

Question: Put 2. (18 points) Short calculation questions. You are given the 1-year option premiums on XYZ stock (non-dividend paying) as shown in the table below:

Put 2. (18 points) Short calculation questions. You are given the 1-year option premiums on XYZ stock (non-dividend paying) as shown in the table below: Strike Call Price Premium Premium 90 14.81 3.02 100 8.92 6.94 110 4.94 12.77 The spot price of XYZ is 100, and the continuously compounded risk free interest rate is 2%. (a) State which option positions from the table above are required to enter into a long strangle using 90 and 110 strike options. Write out the profit function for the strangle. [6 points] (b) State which option positions from the table above are required to enter into a short straddle using 100 strike options. Write out the profit function for the short straddle. [6 points] (c) Suppose that you combine the positions from parts (a) and (b). Plot the profit function of the combined option strategy and label all critical points. State the name for this option strategy. [6 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts