Question: PUT - CALL PARITY Consider a call c and a put option p written on the same underlying S with the same strike K ,

PUTCALL PARITY

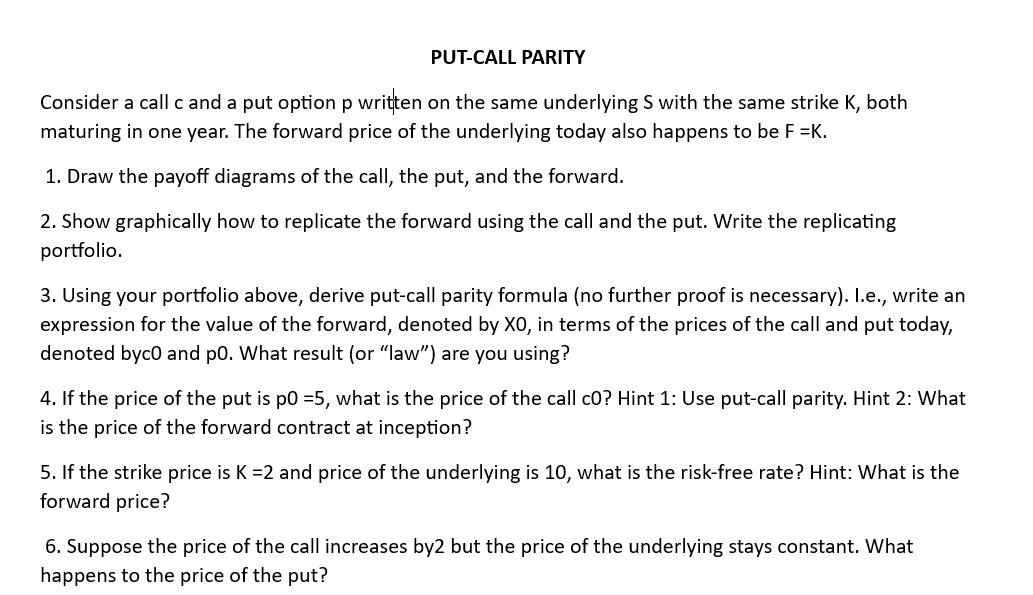

Consider a call c and a put option p written on the same underlying S with the same strike K both maturing in one year. The forward price of the underlying today also happens to be mathrmFmathrmK

Draw the payoff diagrams of the call, the put, and the forward.

Show graphically how to replicate the forward using the call and the put. Write the replicating portfolio.

Using your portfolio above, derive putcall parity formula no further proof is necessary I.e write an expression for the value of the forward, denoted by XO in terms of the prices of the call and put today, denoted byc and p What result or "law" are you using?

If the price of the put is mathrmpO what is the price of the call cO Hint : Use putcall parity. Hint : What is the price of the forward contract at inception?

If the strike price is mathrmK and price of the underlying is what is the riskfree rate? Hint: What is the forward price?

Suppose the price of the call increases by but the price of the underlying stays constant. What happens to the price of the put?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock