Question: Put your team's answer to each question on a separate page. Include diagrams and or mathematical expressions where appropriate. (Neat hand-drawn diagrams and hand-written mathematical

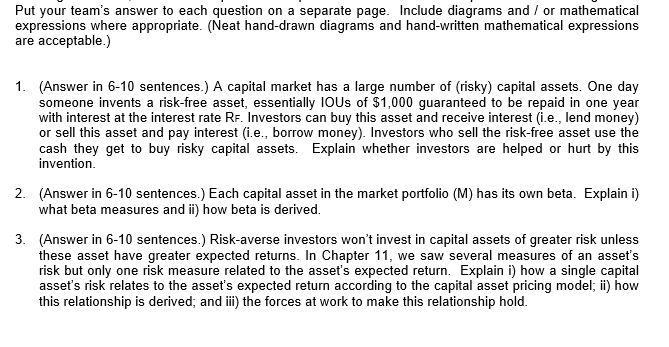

Put your team's answer to each question on a separate page. Include diagrams and or mathematical expressions where appropriate. (Neat hand-drawn diagrams and hand-written mathematical expressions are acceptable.) 1. (Answer in 6-10 sentences.) A capital market has a large number of (risky) capital assets. One day someone invents a risk-free asset, essentially IOUs of $1,000 guaranteed to be repaid in one year with interest at the interest rate RF. Investors can buy this asset and receive interest (i.e., lend money) or sell this asset and pay interest (i.e., borrow money). Investors who sell the risk-free asset use the cash they get to buy risky capital assets. Explain whether investors are helped or hurt by this invention 2. (Answer in 6-10 sentences.) Each capital asset in the market portfolio (M) has its own beta. Explain i) what bet a measures and i) how beta is derived. 3. (Answer in 6-10 sentences.) Risk-averse investors won't invest in capital assets of greater risk unless these asset have greater expected returns. In Chapter 11, we saw several measures of an asset's risk but only one risk measure related to the asset's expected return. Explain i) how a single capital asset's risk relates to the asset's expected return according to the capital asset pricing model; ii) how this relationship is derived, and il) the forces at work to make this relationship hold. Put your team's answer to each question on a separate page. Include diagrams and or mathematical expressions where appropriate. (Neat hand-drawn diagrams and hand-written mathematical expressions are acceptable.) 1. (Answer in 6-10 sentences.) A capital market has a large number of (risky) capital assets. One day someone invents a risk-free asset, essentially IOUs of $1,000 guaranteed to be repaid in one year with interest at the interest rate RF. Investors can buy this asset and receive interest (i.e., lend money) or sell this asset and pay interest (i.e., borrow money). Investors who sell the risk-free asset use the cash they get to buy risky capital assets. Explain whether investors are helped or hurt by this invention 2. (Answer in 6-10 sentences.) Each capital asset in the market portfolio (M) has its own beta. Explain i) what bet a measures and i) how beta is derived. 3. (Answer in 6-10 sentences.) Risk-averse investors won't invest in capital assets of greater risk unless these asset have greater expected returns. In Chapter 11, we saw several measures of an asset's risk but only one risk measure related to the asset's expected return. Explain i) how a single capital asset's risk relates to the asset's expected return according to the capital asset pricing model; ii) how this relationship is derived, and il) the forces at work to make this relationship hold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts