Question: PV changes when you change multiple may be more realistic than sensitivity analysis les may be correlated in reality. d. None of the above. You

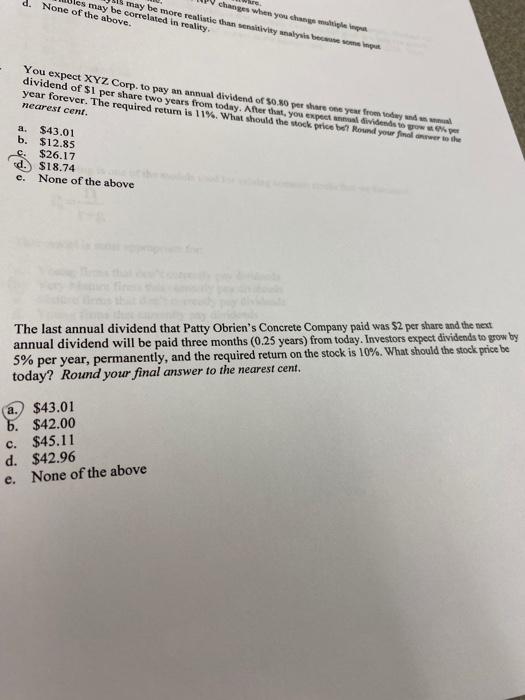

PV changes when you change multiple may be more realistic than sensitivity analysis les may be correlated in reality. d. None of the above. You expect XYZ Corp. to pay an annual dividend of $0.30 per share one year from dividend of $i per share two years from today. After that, you expect na dividends to grow w e year forever. The required return is 11%. What should the stock price Round your final anwer to the nearest cent. a. $43.01 b. $12.85 c. $26.17 d. $18.74 e. None of the above The last annual dividend that Patty Obrien's Concrete Company paid was $2 per share and the next annual dividend will be paid three months (0.25 years) from today. Investors expect dividends to grow by 5% per year, permanently, and the required return on the stock is 10%. What should the stock price be today? Round your final answer to the nearest cent. a. $43.01 b. $42.00 c. $45.11 d. $42.96 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts