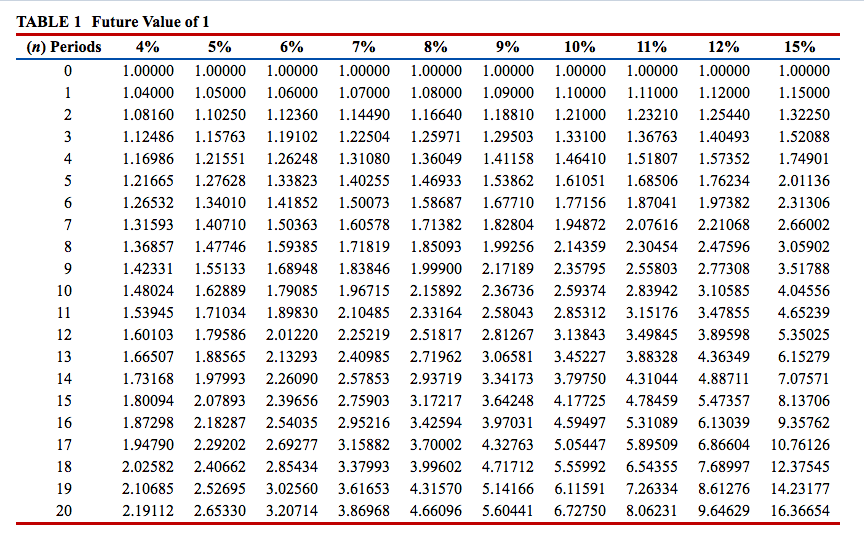

Question: PV Table: Do It Review 26-2 Wayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $132,085. It will

PV Table:

PV Table:

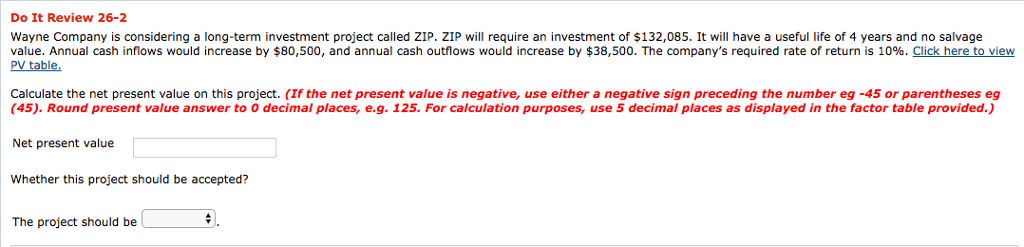

Do It Review 26-2 Wayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $132,085. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $80,500, and annual cash out o s would increase by 38 500. The companys equi e ate of re r is 10% h e to i PV table. Calculate the net present value on this project. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round present value answer to 0 decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value Whether this project should be accepted? The project should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts