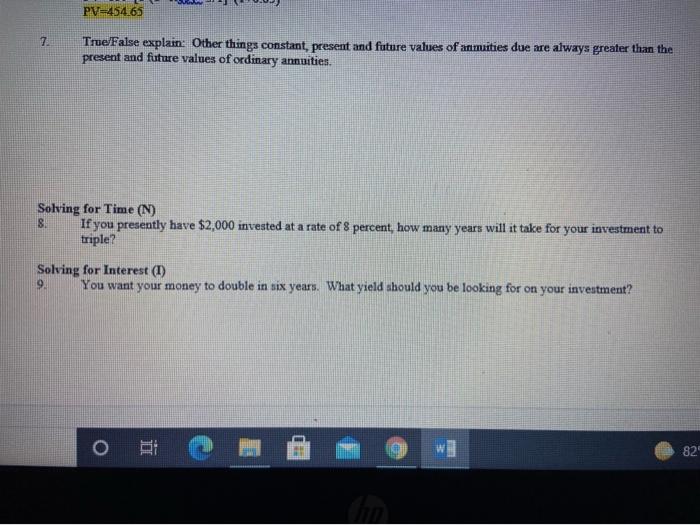

Question: PV=454.65 7 True/False explain: Other things constant, present and future values of anmuities due are always greater than the present and future values of ordinary

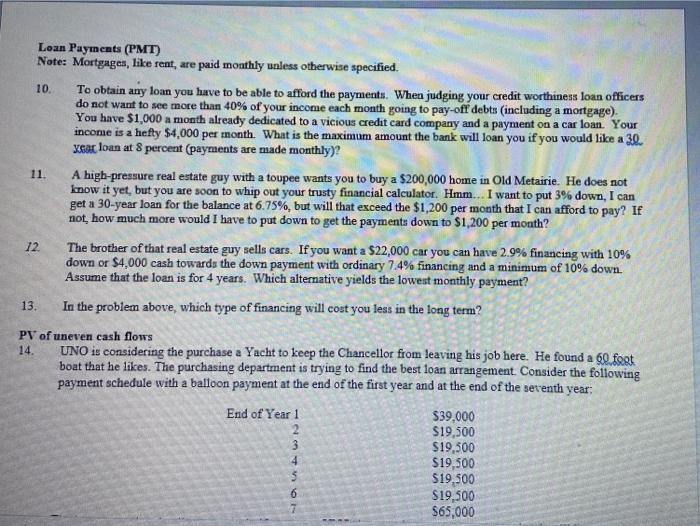

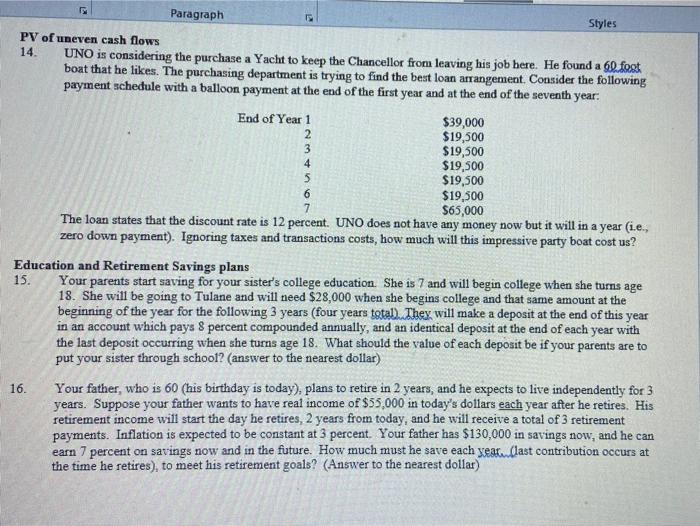

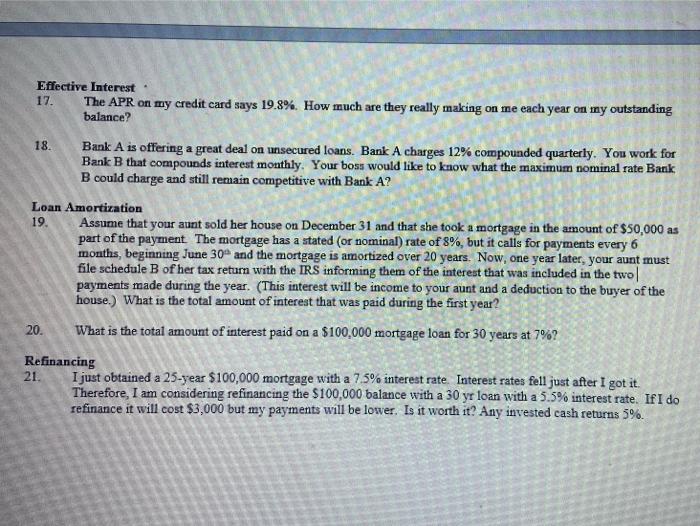

PV=454.65 7 True/False explain: Other things constant, present and future values of anmuities due are always greater than the present and future values of ordinary annuities. Solving for Time (N) S. If you presently have $2,000 invested at a rate of 8 percent, how many years will it take for your investment to triple? Solving for Interest (1) 9. You want your money to double in six years. What yield should you be looking for on your investment? O E L. 82" 11. Loan Payments (PMT) Note: Mortgages, like rent, are paid monthly unless otherwise specified. 10. To obtain any loan you have to be able to afford the payments. When judging your credit worthiness loan officers do not want to see more than 40% of your income each month going to pay-off debts (including a mortgage). You have $1,000 a month already dedicated to a vicious credit card company and a payment on a car loan Your income is a hefty $4,000 per month. What is the maximum amount the bank will loan you if you would like a 3.0 year loan at 8 percent (payments are made monthly)? A high-pressure real estate guy with a toupee wants you to buy a $200,000 home in Old Metairie. He does not know it yet, but you are soon to whip out your trusty financial calculator. Hmm... I want to put 3% down, I can get a 30-year loan for the balance at 6.75%, but will that exceed the $1,200 per month that I can afford to pay? If not, how much more would I have to put down to get the payments down to $1,200 per month? 12 The brother of that real estate guy sells cars. If you want a $22,000 car you can have 2.9% financing with 10% down or $4,000 cash towards the down payment with ordinary 7.4% financing and a minimum of 10% down. Assume that the loan is for 4 years. Which alternative yields the lowest monthly payment? In the problem above, which type of financing will cost you less in the long term? PV of uneven cash flows 14. UNO is considering the purchase a Yacht to keep the Chancellor from leaving his job here. He found a 60 foot boat that he likes. The purchasing department is trying to find the best loan arrangement. Consider the following payment schedule with a balloon payment at the end of the first year and at the end of the seventh year: End of Year 1 $39,000 2 $19,500 $19,500 $19,500 $19,500 $19,500 $65,000 13. 3 4 6 2 4 7 Paragraph Styles PV of uneven cash flows 14. UNO is considering the purchase a Yacht to keep the Chancellor from leaving his job here. He found a 60 fost bout that he likes. The purchasing department is trying to find the best loan arrangement. Consider the following payment schedule with a balloon payment at the end of the first year and at the end of the seventh year: End of Year 1 $39,000 $19,500 3 $19,500 $19,500 5 $19,500 6 $19,500 $65,000 The loan states that the discount rate is 12 percent. UNO does not have any money now but it will in a year (i.e., zero down payment). Ignoring taxes and transactions costs, how much will this impressive party boat cost us? Education and Retirement Savings plans 15. Your parents start saving for your sister's college education. She is 7 and will begin college when she turns age 18. She will be going to Tulane and will need $28,000 when she begins college and that same amount at the beginning of the year for the following 3 years (four years total). They will make a deposit at the end of this year in an account which pays 8 percent compounded annually, and an identical deposit at the end of each year with the last deposit occurring when she turns age 18. What should the value of each deposit be if your parents are to put your sister through school? (answer to the nearest dollar) Your father, who is 60 (his birthday is today), plans to retire in 2 years, and he expects to live independently for 3 years. Suppose your father wants to have real income of $55,000 in today's dollars each year after he retires. His retirement income will start the day he retires, 2 years from today, and he will receive a total of 3 retirement payments. Inflation is expected to be constant at 3 percent. Your father has $130,000 in savings now, and he can earn 7 percent on savings now and in the future. How much must he save each year (last contribution occurs at the time he retires), to meet his retirement goals? (Answer to the nearest dollar) 16. 18. Effective Interest - 17. The APR on my credit card says 19.8%. How much are they really making on me each year on my outstanding balance? Bank A is offering a great deal on unsecured loans. Bank A charges 12% compounded quarterly. You work for Bank B that compounds interest monthly. Your boss would like to know what the maximum nominal rate Bank B could charge and still remain competitive with Bank A? Loan Amortization Assume that your aunt sold her house on December 31 and that she took a mortgage in the amount of $50,000 as part of the payment. The mortgage has a stated (or nominal) rate of 8%, but it calls for payments every 6 months, beginning June 30 and the mortgage is amortized over 20 years. Now, one year later, your aunt must file schedule B of her tax return with the IRS informing them of the interest that was included in the two payments made during the year. (This interest will be income to your aunt and a deduction to the buyer of the house.) What is the total amount of interest that was paid during the first year? What is the total amount of interest paid on a $100,000 mortgage loan for 30 years at 7%? 19 20. Refinancing 21 I just obtained a 25-year $100,000 mortgage with a 7.5% interest rate Interest rates fell just after I got it. Therefore, I am considering refinancing the $100,000 balance with a 30 yr loan with a 5.5% interest rate. If I do refinance it will cost $3,000 but my payments will be lower. Is it worth it? Any invested cash returns 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts