Question: PVGO calculation practice Fill in the missing numbers A firm will pay a year-end dividend of $2.40 per share, which is expected to grow at

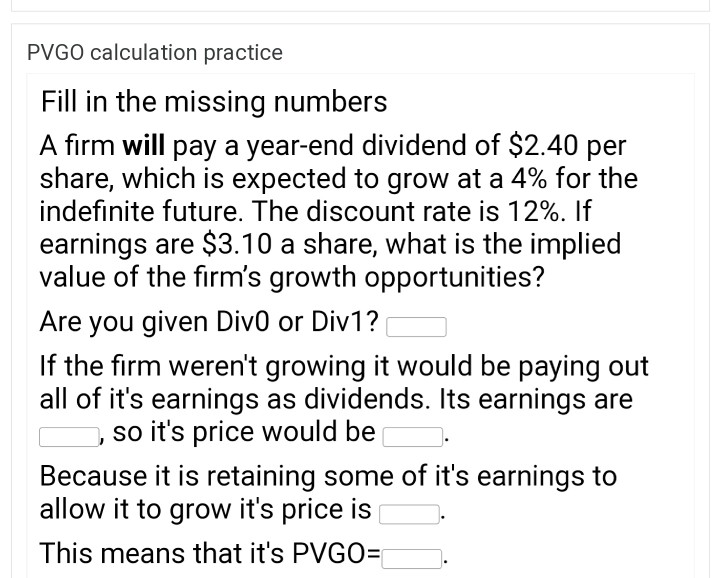

PVGO calculation practice

Fill in the missing numbers

A firm will pay a year-end dividend of $2.40 per share, which is expected to grow at a 4% for the indefinite future. The discount rate is 12%. If earnings are $3.10 a share, what is the implied value of the firms growth opportunities?

Are you given Div0 or Div1? _______

If the firm weren't growing it would be paying out all of it's earnings as dividends. Its earnings are ________ , so it's price would be ________ .

Because it is retaining some of it's earnings to allow it to grow it's price is ________.

This means that it's PVGO=________.

PVGO calculation practice Fill in the missing numbers A firm will pay a year-end dividend of $2.40 per share, which is expected to grow at a 4% for the indefinite future. The discount rate is 12%. If earnings are $3.10 a share, what is the implied value of the firm's growth opportunities? Are you given Divo or Divi? If the firm weren't growing it would be paying out all of it's earnings as dividends. Its earnings are O , so it's price would be Because it is retaining some of it's earnings to allow it to grow it's price is This means that it's PVGO=r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts