Question: PYTHON 1. Design a Tax_paying implementation as follows: A Tax_paying abstract class with an input named salary and an abstract method as calculate_tax_value A StudentTaxPaying

PYTHON

PYTHON

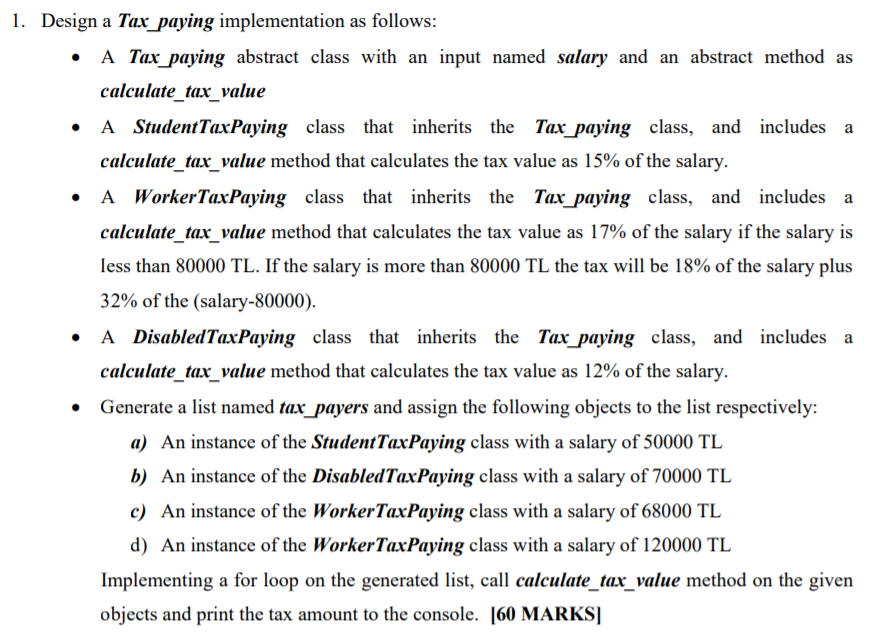

1. Design a Tax_paying implementation as follows: A Tax_paying abstract class with an input named salary and an abstract method as calculate_tax_value A StudentTaxPaying class that inherits the Tax_paying class, and includes a calculate_tax_value method that calculates the tax value as 15% of the salary. A WorkerTax Paying class that inherits the Tax_paying class, and includes a calculate_tax_value method that calculates the tax value as 17% of the salary if the salary is less than 80000 TL. If the salary is more than 80000 TL the tax will be 18% of the salary plus 32% of the (salary-80000). A Disabled Tax Paying class that inherits the Tax_paying class, and includes a calculate_tax_value method that calculates the tax value as 12% of the salary. Generate a list named tax_payers and assign the following objects to the list respectively: a) An instance of the StudentTax Paying class with a salary of 50000 TL b) An instance of the Disabled TaxPaying class with a salary of 70000 TL c) An instance of the WorkerTaxPaying class with a salary of 68000 TL d) An instance of the WorkerTaxPaying class with a salary of 120000 TL Implementing a for loop on the generated list, call calculate_tax_value method on the given objects and print the tax amount to the console. [60 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts