Question: python BCC LLC is a company that sells products to customers worldwide. The company is required to pay both the state and county taxes before

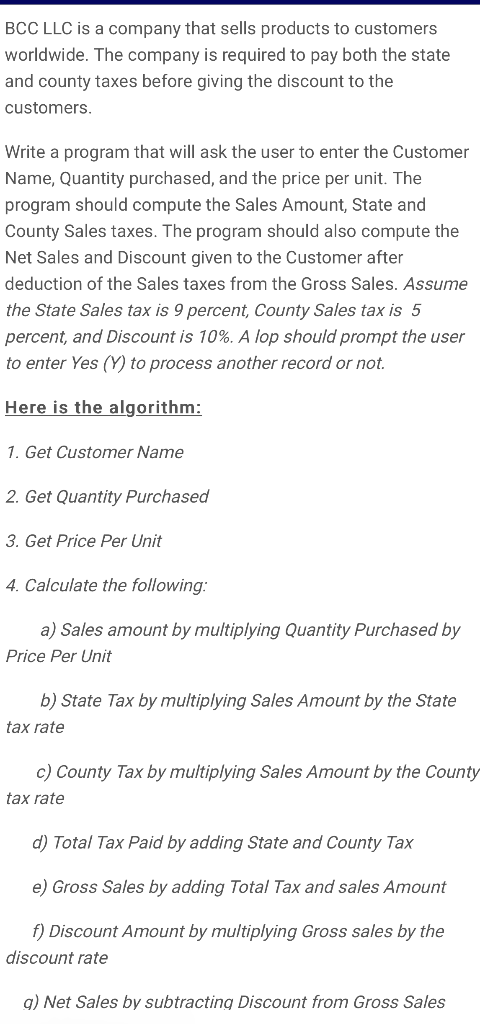

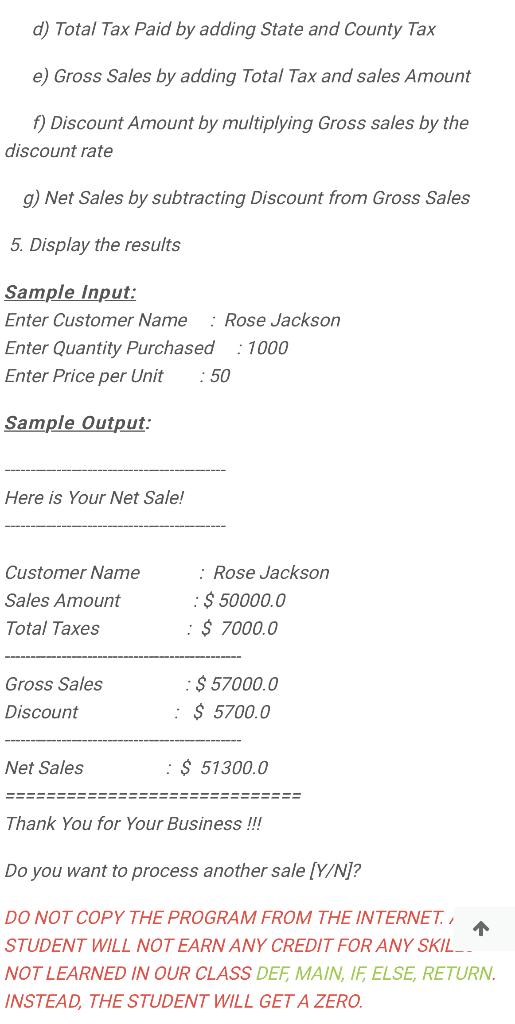

BCC LLC is a company that sells products to customers worldwide. The company is required to pay both the state and county taxes before giving the discount to the customers. Write a program that will ask the user to enter the Customer Name, Quantity purchased, and the price per unit. The program should compute the Sales Amount, State and County Sales taxes. The program should also compute the Net Sales and Discount given to the Customer after deduction of the Sales taxes from the Gross Sales. Assume the State Sales tax is 9 percent, County Sales tax is 5 percent, and Discount is 10%. A lop should prompt the user to enter Yes (Y) to process another record or not. Here is the algorithm: 1. Get Customer Name 2. Get Quantity Purchased 3. Get Price Per Unit 4. Calculate the following: a) Sales amount by multiplying Quantity Purchased by Price Per Unit b) State Tax by multiplying Sales Amount by the State tax rate c) County Tax by multiplying Sales Amount by the County tax rate d) Total Tax Paid by adding State and County Tax e) Gross Sales by adding Total Tax and sales Amount f) Discount Amount by multiplying Gross sales by the discount rate q) Net Sales by subtractinq Discount from Gross Sales d) Total Tax Paid by adding State and County Tax e) Gross Sales by adding Total Tax and sales Amount f) Discount Amount by multiplying Gross sales by the discount rate g) Net Sales by subtracting Discount from Gross Sales 5. Display the results Sample Input: Enter Customer Name : Rose Jackson Enter Quantity Purchased : 1000 Enter Price per Unit :50 Sample Output: Here is Your Net Sale! Thank You for Your Business !!! Do you want to process another sale [Y/N] ? DO NOT COPY THE PROGRAM FROM THE INTERNET., STUDENT WILL NOT EARN ANY CREDIT FOR ANY SKIL NOT LEARNED IN OUR CLASS DEF, MAIN, IF, ELSE, RETURN. INSTEAD, THE STUDENT WILL GET A ZERO. BCC LLC is a company that sells products to customers worldwide. The company is required to pay both the state and county taxes before giving the discount to the customers. Write a program that will ask the user to enter the Customer Name, Quantity purchased, and the price per unit. The program should compute the Sales Amount, State and County Sales taxes. The program should also compute the Net Sales and Discount given to the Customer after deduction of the Sales taxes from the Gross Sales. Assume the State Sales tax is 9 percent, County Sales tax is 5 percent, and Discount is 10%. A lop should prompt the user to enter Yes (Y) to process another record or not. Here is the algorithm: 1. Get Customer Name 2. Get Quantity Purchased 3. Get Price Per Unit 4. Calculate the following: a) Sales amount by multiplying Quantity Purchased by Price Per Unit b) State Tax by multiplying Sales Amount by the State tax rate c) County Tax by multiplying Sales Amount by the County tax rate d) Total Tax Paid by adding State and County Tax e) Gross Sales by adding Total Tax and sales Amount f) Discount Amount by multiplying Gross sales by the discount rate q) Net Sales by subtractinq Discount from Gross Sales d) Total Tax Paid by adding State and County Tax e) Gross Sales by adding Total Tax and sales Amount f) Discount Amount by multiplying Gross sales by the discount rate g) Net Sales by subtracting Discount from Gross Sales 5. Display the results Sample Input: Enter Customer Name : Rose Jackson Enter Quantity Purchased : 1000 Enter Price per Unit :50 Sample Output: Here is Your Net Sale! Thank You for Your Business !!! Do you want to process another sale [Y/N] ? DO NOT COPY THE PROGRAM FROM THE INTERNET., STUDENT WILL NOT EARN ANY CREDIT FOR ANY SKIL NOT LEARNED IN OUR CLASS DEF, MAIN, IF, ELSE, RETURN. INSTEAD, THE STUDENT WILL GET A ZERO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts