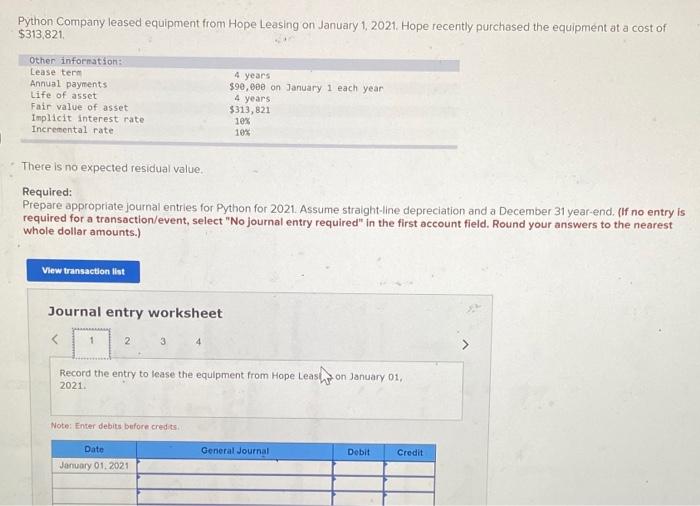

Question: Python Company leased equipment from Hope Leasing on January 1, 2021. Hope recently purchased the equipment at a cost of $313,821 Other information: Lease ter

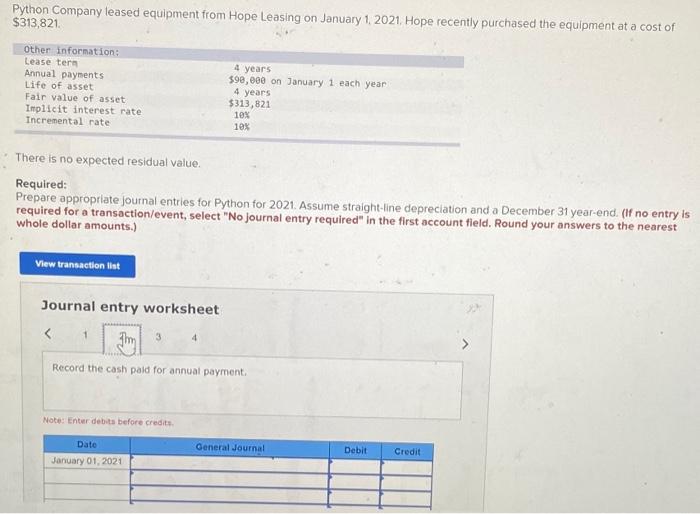

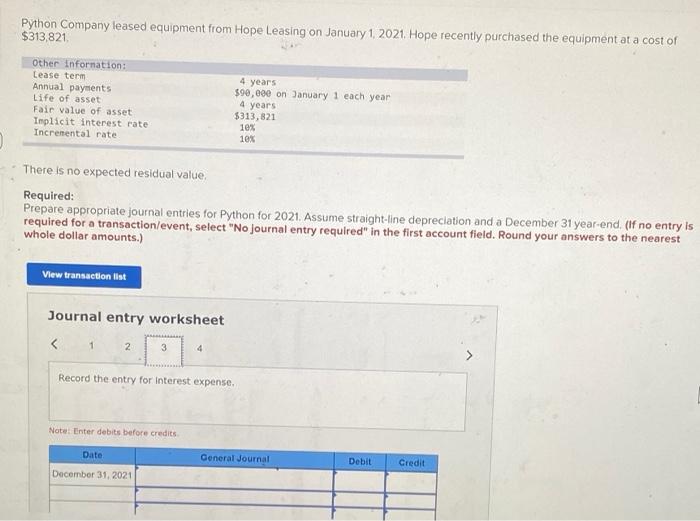

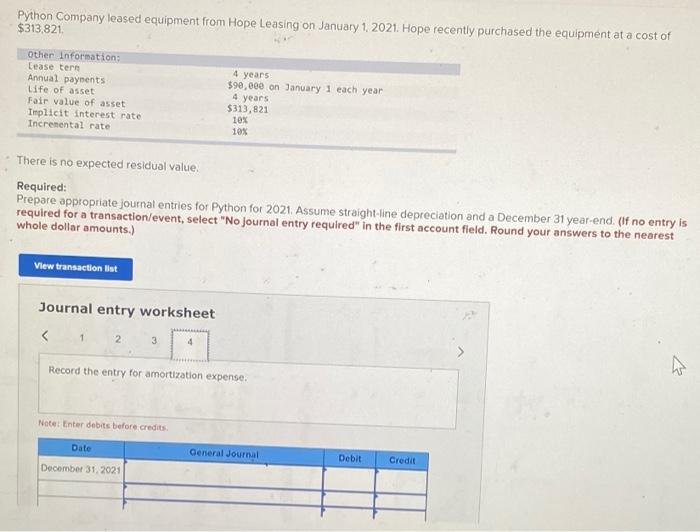

Python Company leased equipment from Hope Leasing on January 1, 2021. Hope recently purchased the equipment at a cost of $313,821 Other information: Lease ter Annual payments Life of asset Fair value of asset Implicit interest rate Incremental rate 4 years $90,000 on January 1 each year 4 years $313,821 10% 10% There is no expected residual value. Required: Prepare appropriate journal entries for Python for 2021 Assume straight-line depreciation and a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View ew transaction list Journal entry worksheet 2 3 4 Record the entry to lease the equipment from Hope Leash on January 01, 2021 Note: Enter debits before credits General Journal Debit Credit Date January 01, 2021 Python Company leased equipment from Hope Leasing on January 1, 2021. Hope recently purchased the equipment at a cost of $313,821 Other information: Lease tern Annual payments Life of asset Fair value of asset Implicit interest rate Incremental rate 4 years 390,000 on January 1 each year 4 years $313,821 10X 10% There is no expected residual value. Required: Prepare appropriate journal entries for Python for 2021. Assume straight-line depreciation and a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View transaction list Journal entry worksheet >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts