Question: Python Homework 5: Financial Credit Rating Instruction: Please upload your jupyter notebook on GauchoSpace with filename PythonHW5 YOURPERMNUMBER.ipynb. In Mathematical Finance, Markov chains are typically

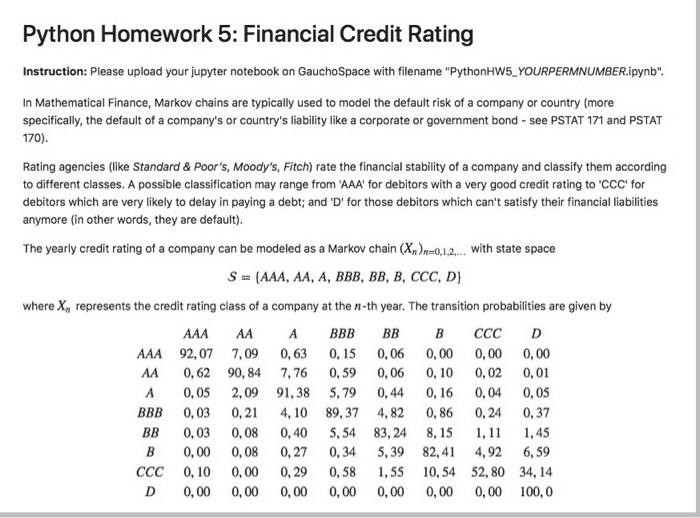

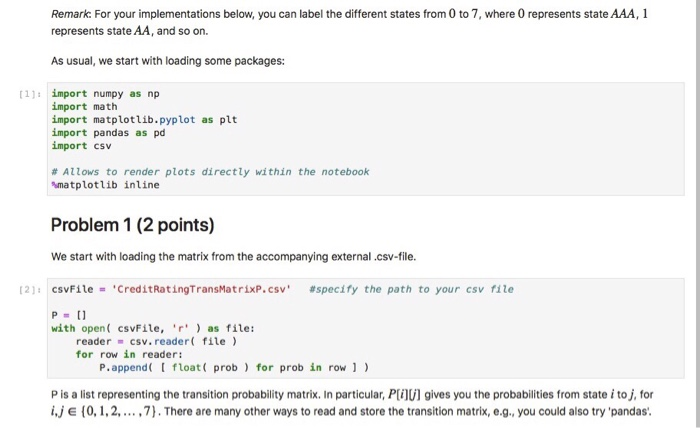

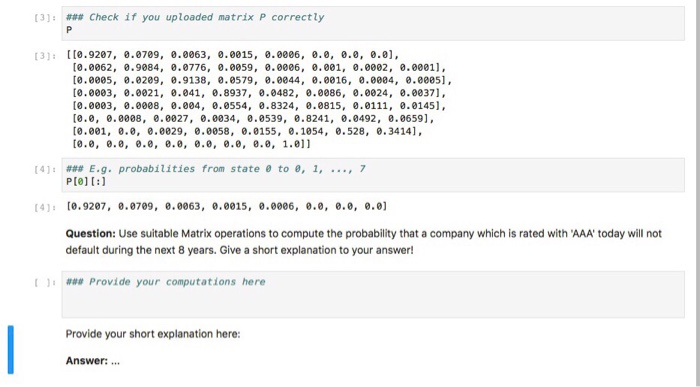

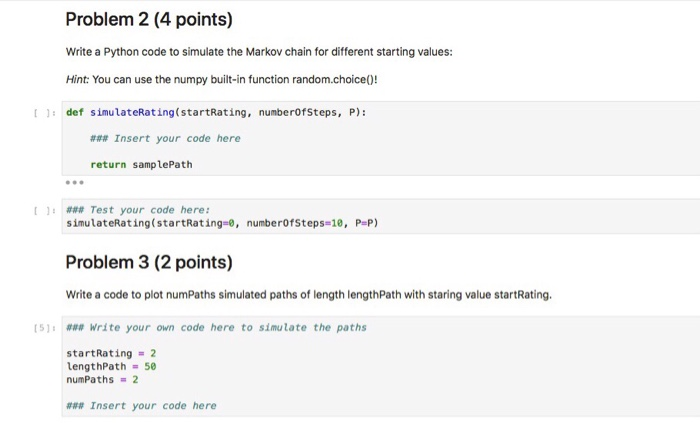

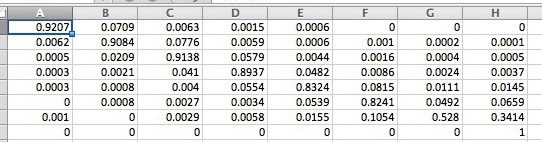

Python Homework 5: Financial Credit Rating Instruction: Please upload your jupyter notebook on GauchoSpace with filename "PythonHW5 YOURPERMNUMBER.ipynb". In Mathematical Finance, Markov chains are typically used to model the default risk of a company or country (more specifically, the default of a company's or country's liability like a corporate or government bond see PSTAT 171 and PSTAT 170) Rating agencies (like Standard & Poor's, Moody's, Fitch) rate the financial stability of a company and classify them according to different classes. A possible classification may range from 'AAA' for debitors with a very good credit rating to 'CCC' for debitors which are very likely to delay in paying a debt; and 'D' for those debitors which can't satisfy their financial liabilities anymore (in other words, they are default) The yearly credit rating of a company can be modeled as a MarkovchainXnn-01,.. with state space where X, represents the credit rating class of a company at the n-th year. The transition probabilities are given by AAA 92,07 7,09 0,63 0,15 0,06 0,00 0,00 0,00 AA 0,62 90,84 7,760,59 0,06 0,10 0,02 0,01 A 0,05 2,09 91,38 5,79 0,44 0,16 0,04 0,05 0,03 0,21 4,10 89, 37 4,82 0, 86 0,24 0,37 BB 0, 03 0,08 0,40 5,54 83,24 8,15 1,45 B 0,00 0,08 0,27 0,34 5,39 82,41 4,92 6,59 CCC 0,10 0,00 0,29 0,58 1,55 10,54 52,80 34, 14 D 0,00 0,00 0,00 0,00 0,00 0,00 0,00 100,0 Python Homework 5: Financial Credit Rating Instruction: Please upload your jupyter notebook on GauchoSpace with filename "PythonHW5 YOURPERMNUMBER.ipynb". In Mathematical Finance, Markov chains are typically used to model the default risk of a company or country (more specifically, the default of a company's or country's liability like a corporate or government bond see PSTAT 171 and PSTAT 170) Rating agencies (like Standard & Poor's, Moody's, Fitch) rate the financial stability of a company and classify them according to different classes. A possible classification may range from 'AAA' for debitors with a very good credit rating to 'CCC' for debitors which are very likely to delay in paying a debt; and 'D' for those debitors which can't satisfy their financial liabilities anymore (in other words, they are default) The yearly credit rating of a company can be modeled as a MarkovchainXnn-01,.. with state space where X, represents the credit rating class of a company at the n-th year. The transition probabilities are given by AAA 92,07 7,09 0,63 0,15 0,06 0,00 0,00 0,00 AA 0,62 90,84 7,760,59 0,06 0,10 0,02 0,01 A 0,05 2,09 91,38 5,79 0,44 0,16 0,04 0,05 0,03 0,21 4,10 89, 37 4,82 0, 86 0,24 0,37 BB 0, 03 0,08 0,40 5,54 83,24 8,15 1,45 B 0,00 0,08 0,27 0,34 5,39 82,41 4,92 6,59 CCC 0,10 0,00 0,29 0,58 1,55 10,54 52,80 34, 14 D 0,00 0,00 0,00 0,00 0,00 0,00 0,00 100,0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts