Question: PYTHON In the markdown cell of your program write a comment explaining what the program does. Use more comments in the program. Ask the user

PYTHON

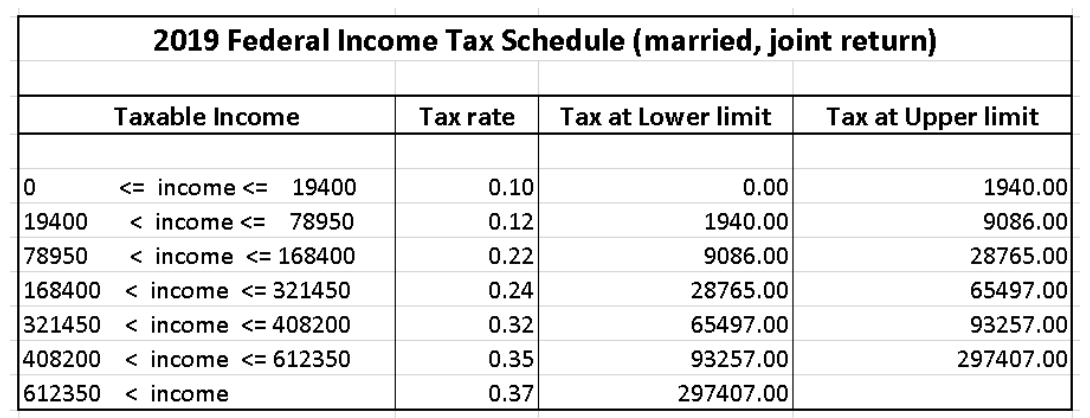

In the markdown cell of your program write a comment explaining what the program does. Use more comments in the program. Ask the user to input his taxable income and store it Next, calculate the income tax the taxpayer must pay according to the table below. Display the taxable income and the income tax with appropriate message(s). Test your program by running it 3 times with the following input. See the examples below the table as well. Verify that your program gets the same answers. 17,500.00 67,400.00 325,050.00 Submit results for taxable income of $325,050 for a married couple filing Joint return.

Example 1: for a taxable income of $22,500, the income tax = $1,940 + $3, 100 * 0.12 = $2,312 Example 2: for a taxable income of $90,000, the income tax = $9,086 + $11 ,050 *0.22 = $11, 517 Example 3: for a taxable income of $215,000, the income tax = $28,765 + $46,600 * 0.24 = $39,949

2019 Federal Income Tax Schedule (married, joint return) Taxable Income Tax rate Tax at Lower limit Tax at Upper limit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts