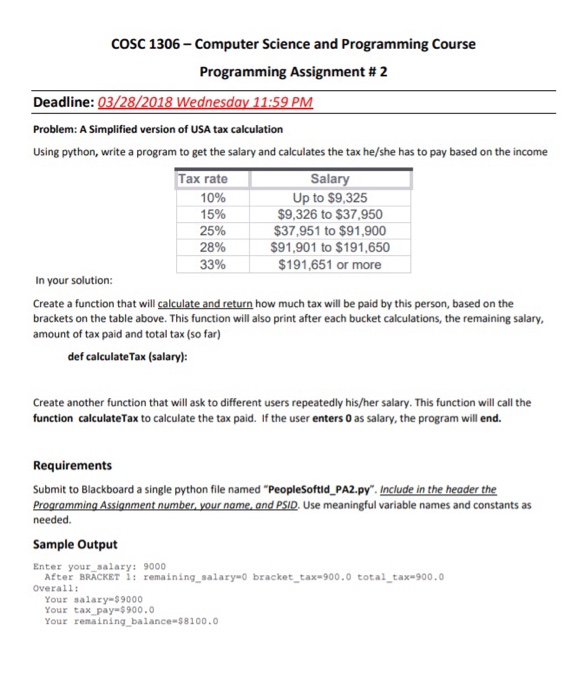

Question: PYTHON PROGAMMING ASSIGNMENT COSC 1306- Computer Science and Programming Course Programming Assignment # 2 Deadline Problem: A Simplified version of USA tax calculation Using python,

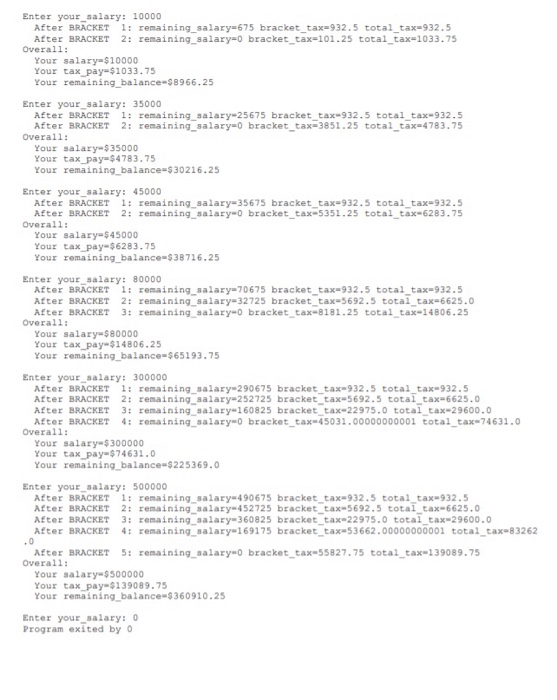

COSC 1306- Computer Science and Programming Course Programming Assignment # 2 Deadline Problem: A Simplified version of USA tax calculation Using python, write a program to get the salary and calculates the tax he/she has to pay based on the income Tax rate 1096 15% 25% 28% 33% Sala Up to $9,325 $9,326 to $37,950 $37,951 to $91,900 S91,901 to $191,650 $191,651 or more In your solution: Create a function that will calculate and return how much tax will be paid by this person, based on the brackets on the table above. This function will also print after each bucket calculations, the remaining salary amount of tax paid and total tax (so far) def calculate Tax (salary): Create another function that will ask to different users repeatedly his/her salary. This function will call the function calculateTax to calculate the tax paid. If the user enters 0 as salary, the program will end. Requirements Submit to Blackboard a single python file named "PeopleSoftid_PA2.py. Include in the header the Programming Assignment number,your name, and PSID. Use meaningful variable names and constants as needed Sample Output Enter your salary: 9000 After BRACKET : remaining salary-0 bracket tax-900.0 total tax-900.0 Overall: Your salary-$9000 Your tax _pay- $900.0 Your remaining balance- $81000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts