Question: python The following table from the Australian Tax Office website describes the formula applied to calculate the amount of income tax that must be paid.

python

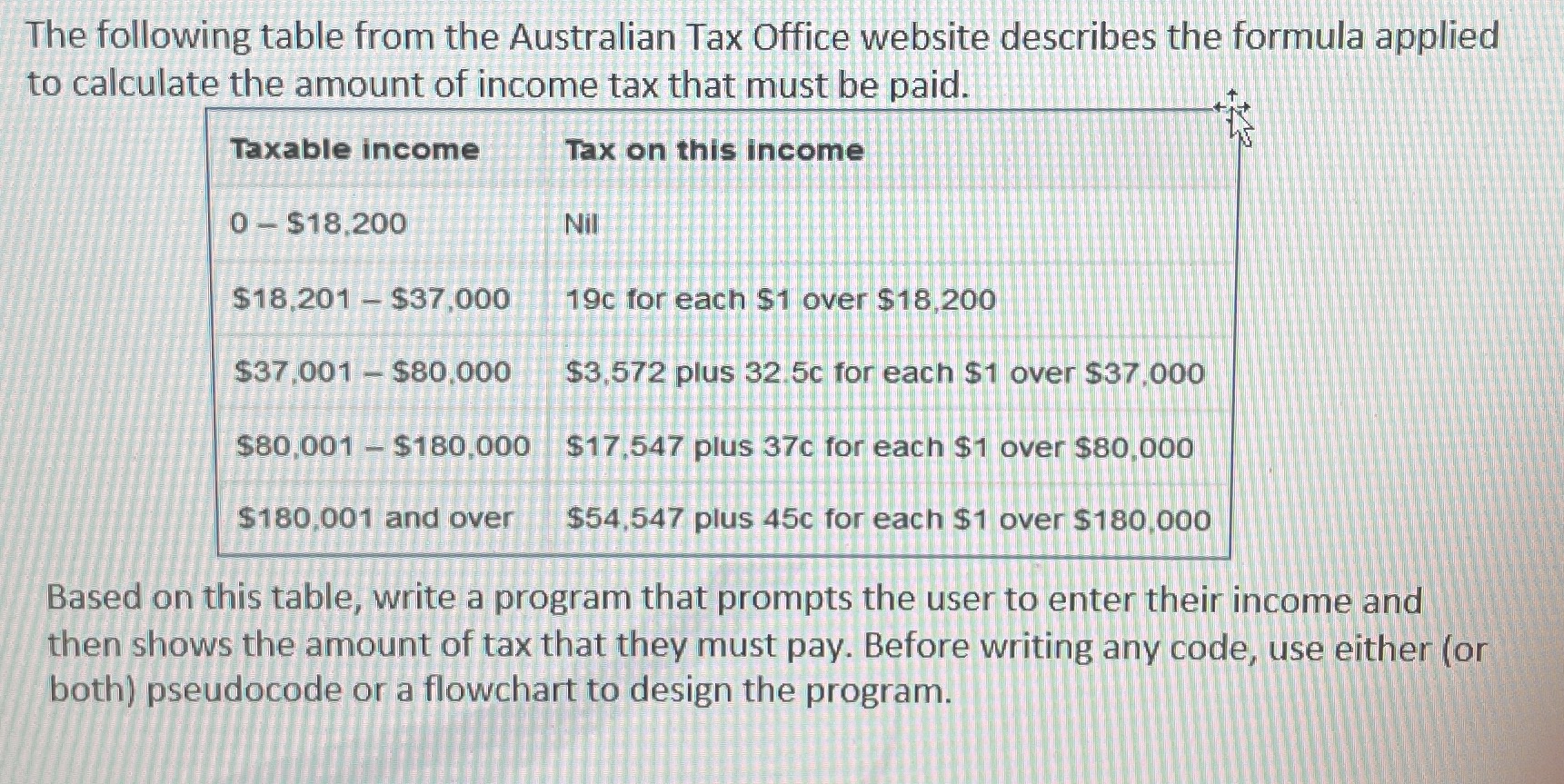

The following table from the Australian Tax Office website describes the formula applied to calculate the amount of income tax that must be paid. Taxable income Tax on this income 0 - $18.200 Nil $18,201 - $37,000 19c for each $1 over $18.200 $37,001 - $80.000 $3,572 plus 32.5c for each $1 over $37.000 $80,001 - $180,000 $17.547 plus 37c for each $1 over $80,000 $180.001 and over $54,547 plus 45c for each $1 over $180.000 Based on this table, write a program that prompts the user to enter their income and then shows the amount of tax that they must pay. Before writing any code, use either (or both) pseudocode or a flowchart to design the program

The following table from the Australian Tax Office website describes the formula applied to calculate the amount of income tax that must be paid. Taxable income Tax on this income 0-$18,200 $18,201 -$37,000 - $37,001 $80,000 $80,001 $180,000 $180,001 and over Nil 19c for each $1 over $18,200 $3,572 plus 32.5c for each $1 over $37,000 $17,547 plus 37c for each $1 over $80,000 $54,547 plus 45c for each $1 over $180,000 Based on this table, write a program that prompts the user to enter their income and then shows the amount of tax that they must pay. Before writing any code, use either (or both) pseudocode or a flowchart to design the program.

Step by Step Solution

There are 3 Steps involved in it

To design a program that calculates the amount of income tax based on the provided table you can sta... View full answer

Get step-by-step solutions from verified subject matter experts