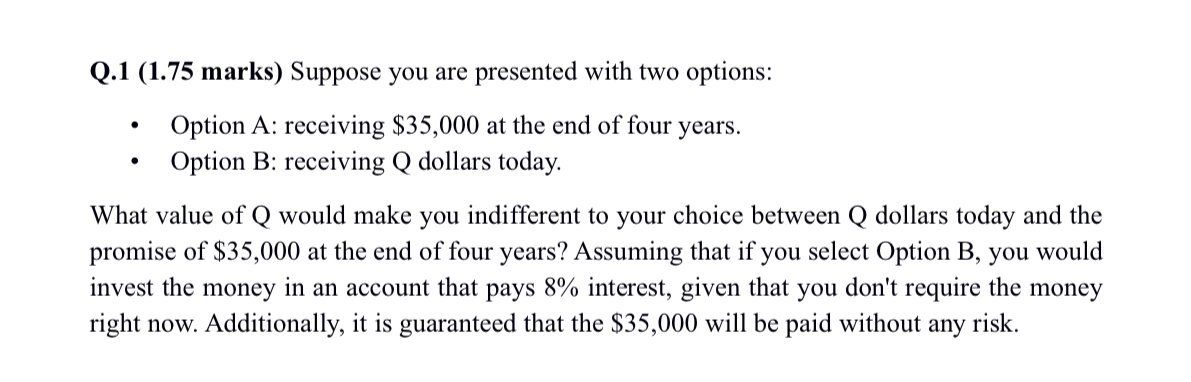

Question: Q . 1 ( 1 . 7 5 marks ) Suppose you are presented with two options: - Option A: receiving ( $

Q marks Suppose you are presented with two options: Option A: receiving $ at the end of four years. Option B: receiving Q dollars today. What value of Q would make you indifferent to your choice between Q dollars today and the promise of $ at the end of four years? Assuming that if you select Option B you would invest the money in an account that pays interest, given that you don't require the money right now. Additionally, it is guaranteed that the $ will be paid without any risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock