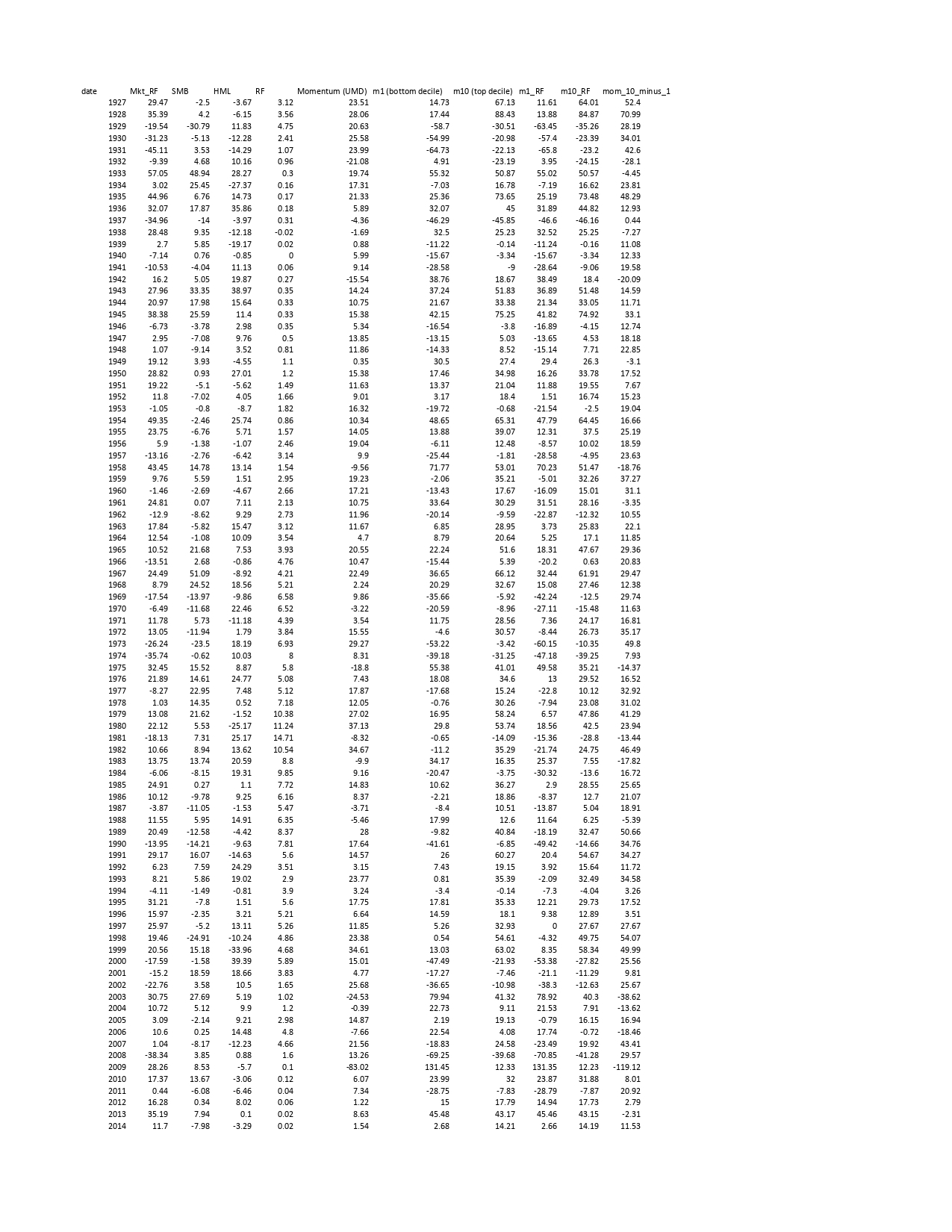

Question: Q 1 . Conduct CAPM and 3 - Factor Model regressions regarding the lowest decile of stocks ranked by past performance ( Decile 1 )

Q Conduct CAPM and Factor Model regressions regarding the lowest decile of stocks ranked by past performance Decile the highest decile of stocks ranked by past performance Decile and the momentum hedge fund strategy that is long Decile and short Decile

Q Consider three hedgefund strategies: the momentum strategy long past winners and short past losers the value strategy long value stocks and short growth stocks and the size strategy long small stocks and short large stocks These strategies are rebalanced each month. Which one of these strategies will likely have the biggest percent change in its portfolio holdings over the course of a year? Answer MOMENTUMVALUE or SIZE

Relevant information attached.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock