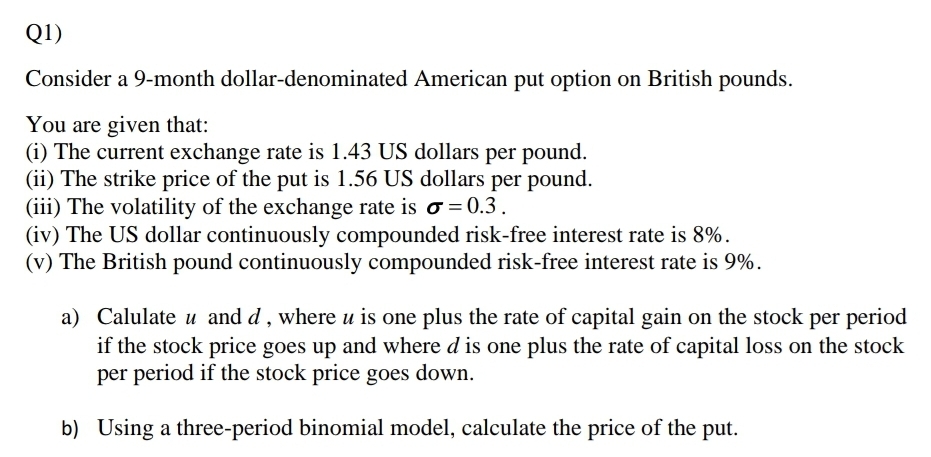

Question: Q 1 ) Consider a 9 - month dollar - denominated American put option on British pounds. You are given that: ( i ) The

Q

Consider a month dollardenominated American put option on British pounds.

You are given that:

i The current exchange rate is US dollars per pound.

ii The strike price of the put is US dollars per pound.

iii The volatility of the exchange rate is

iv The US dollar continuously compounded riskfree interest rate is

v The British pound continuously compounded riskfree interest rate is

a Calulate and where is one plus the rate of capital gain on the stock per period if the stock price goes up and where is one plus the rate of capital loss on the stock per period if the stock price goes down.

b Using a threeperiod binomial model, calculate the price of the put.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock