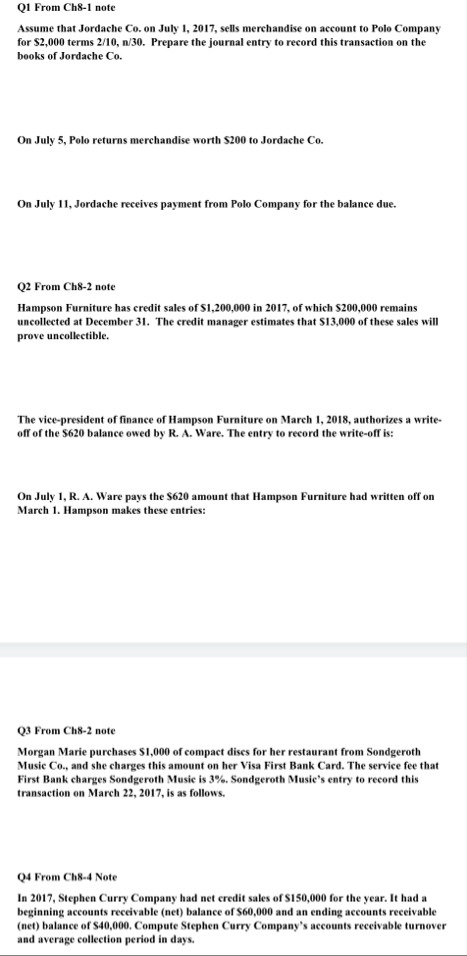

Question: Q 1 From Ch 8 - 1 note Assume that Jordache Co . on July 1 , 2 0 1 7 , sells merchandise on

Q From Ch note

Assume that Jordache Co on July sells merchandise on account to Polo Company for $ terms Prepare the journal entry to record this transaction on the books of Jordache Co

On July Polo returns merchandise worth $ to Jordache Co

On July Jordache receives payment from Polo Company for the balance due.

Q From Ch note

Hampson Furniture has credit sales of $ in of which $ remains uncollected at December The credit manager estimates that $ of these sales will prove uncollectible.

The vicepresident of finance of Hampson Furniture on March authorizes a writeoff of the $ balance owed by R A Ware. The entry to record the writeoff is:

On July R A Ware pays the $ amount that Hampson Furniture had written off on March Hampson makes these entries:

Q From Ch note

Morgan Marie purchases $ of compact discs for her restaurant from Sondgeroth Music Co and she charges this amount on her Visa First Bank Card. The service fee that First Bank charges Sondgeroth Music is Sondgeroth Music's entry to record this transaction on March is as follows.

Q From Ch Note

In Stephen Curry Company had net credit sales of $ for the year. It had a beginning accounts receivable net balance of $ and an ending accounts receivable net balance of $ Compute Stephen Curry Company's accounts receivable turnover and average collection period in days.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock