Question: Q 1 . Gordon Growth Model - Dividend Discount Model ( Chapter 4 , Stock and Stock Valuation ) Please use the following information to

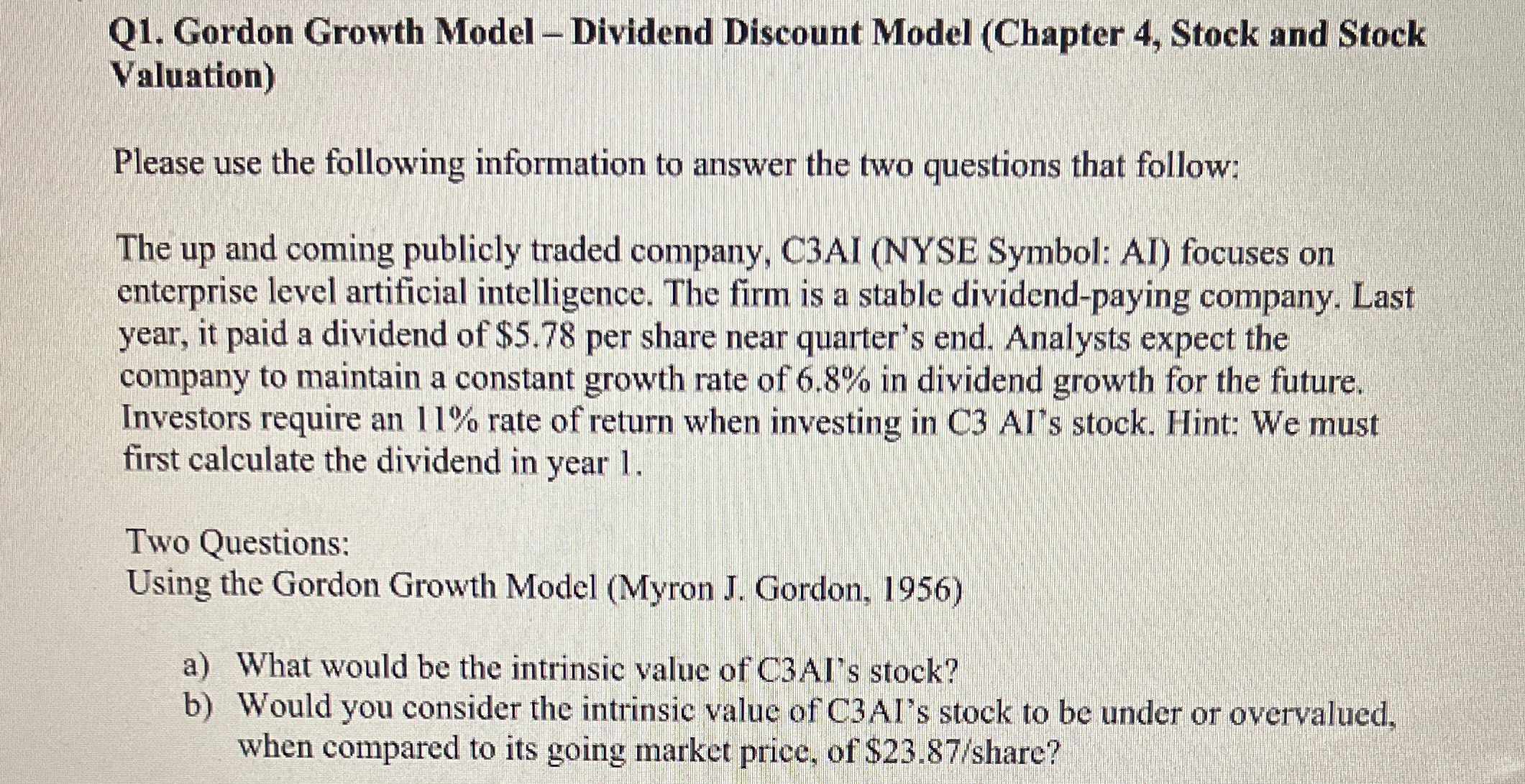

Q Gordon Growth Model Dividend Discount Model Chapter Stock and Stock Valuation

Please use the following information to answer the two questions that follow:

The up and coming publicly traded company, CAI NYSE Symbol: AI focuses on enterprise level artificial intelligence. The firm is a stable dividendpaying company. Last year, it paid a dividend of $ per share near quarter's end. Analysts expect the company to maintain a constant growth rate of in dividend growth for the future. Investors require an rate of return when investing in AI's stock. Hint: We must first calculate the dividend in year

Two Questions:

Using the Gordon Growth Model Myron J Gordon,

a What would be the intrinsic value of s stock?

b Would you consider the intrinsic value of CAI's stock to be under or overvalued, when compared to its going market price, of $ share? Show Formulas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock