Question: Q 1 . ) Suppose ONEX Corp. issued a zero - coupon bond that will mature exactly one year from today. The bond will pay

Q Suppose ONEX Corp. issued a zerocoupon bond that will mature exactly one year from today.

The bond will pay $ in a weak economy, and $ in a strong economy. The bond is AA

rated meaning its not risk free, but fairly safe. The appropriate risk premium for AA rated

bonds is effective annual rate The current riskless rate is EAR The probabilities

of a weak or strong economy are equal.

What is the current fair market value of the bond?

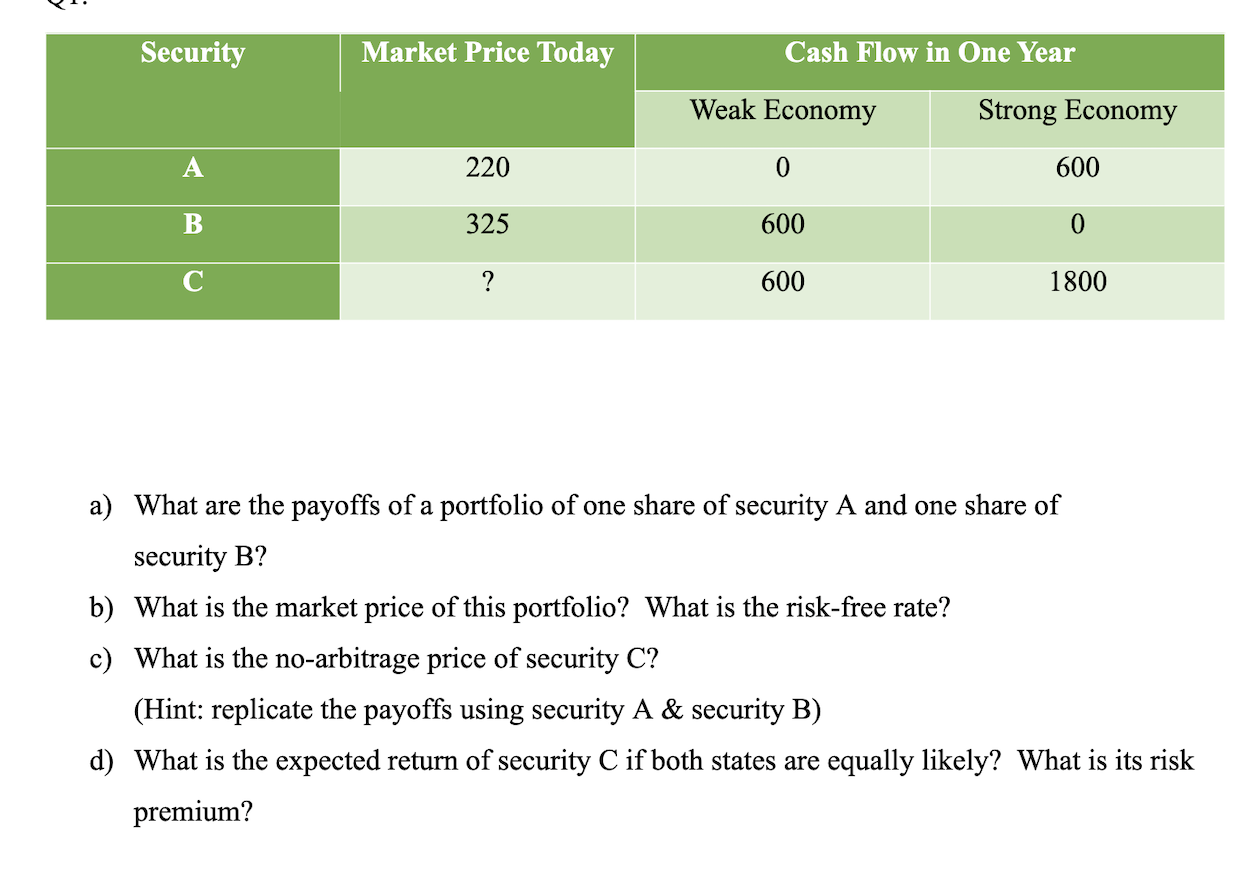

a What are the payoffs of a portfolio of one share of security A and one share of security B

b What is the market price of this portfolio? What is the riskfree rate?

c What is the noarbitrage price of security C

Hint: replicate the payoffs using security A & security B

d What is the expected return of security C if both states are equally likely? What is its risk premium?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock