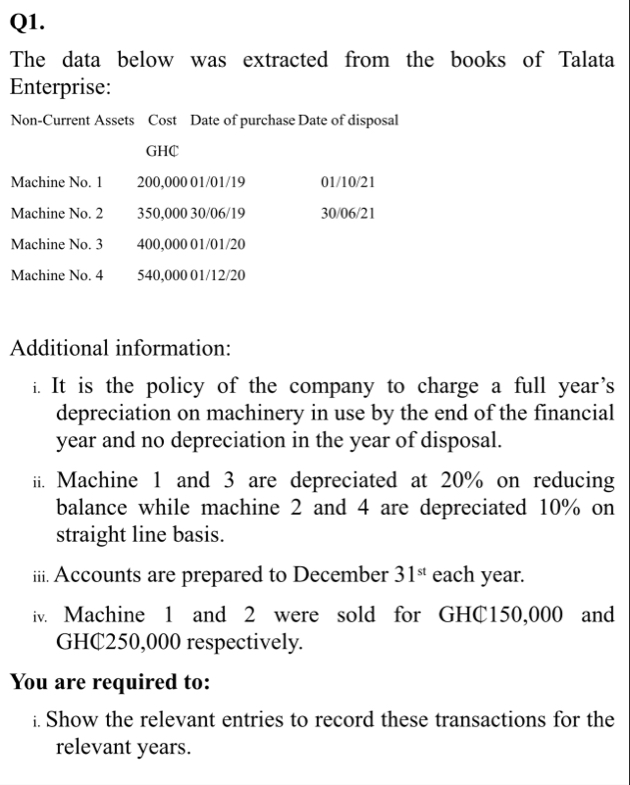

Question: Q 1 . The data below was extracted from the books of Talata Enterprise: table [ [ Non - Current Assets,Cost Date of purchase

Q

The data below was extracted from the books of Talata Enterprise:

tableNonCurrent Assets,Cost Date of purchase Date of disposalGHCMachine NoMachine NoMachine NoMachine No

Additional information:

i It is the policy of the company to charge a full year's depreciation on machinery in use by the end of the financial year and no depreciation in the year of disposal.

ii Machine and are depreciated at on reducing balance while machine and are depreciated on straight line basis.

iii. Accounts are prepared to December each year.

iv Machine and were sold for GHC and GHC respectively.

You are required to:

i Show the relevant entries to record these transactions for the relevant years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock