Question: Q 1(b) Consider a long forward contract maturing in 9-mths to purchase a coupon-bearing bond whose current price is $750. A coupon payment of $40

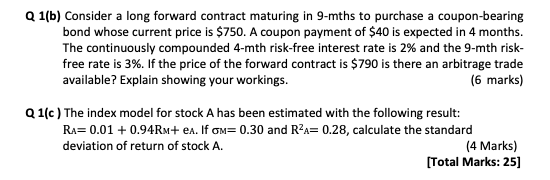

Q 1(b) Consider a long forward contract maturing in 9-mths to purchase a coupon-bearing bond whose current price is $750. A coupon payment of $40 is expected in 4 months. The continuously compounded 4-mth risk-free interest rate is 2% and the 9-mth risk- free rate is 3%. If the price of the forward contract is $790 is there an arbitrage trade available? Explain showing your workings. (6 marks) Q1(c) The index model for stock A has been estimated with the following result: Ra=0.01 +0.94Rm+ ea. If om=0.30 and R2A= 0.28, calculate the standard deviation of return of stock A. (4 Marks) [Total Marks:25]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock