Question: Q 2 2 : Your name is Angela. You work as the CFO of a British company that deals extensively with companies in Nigeria. You

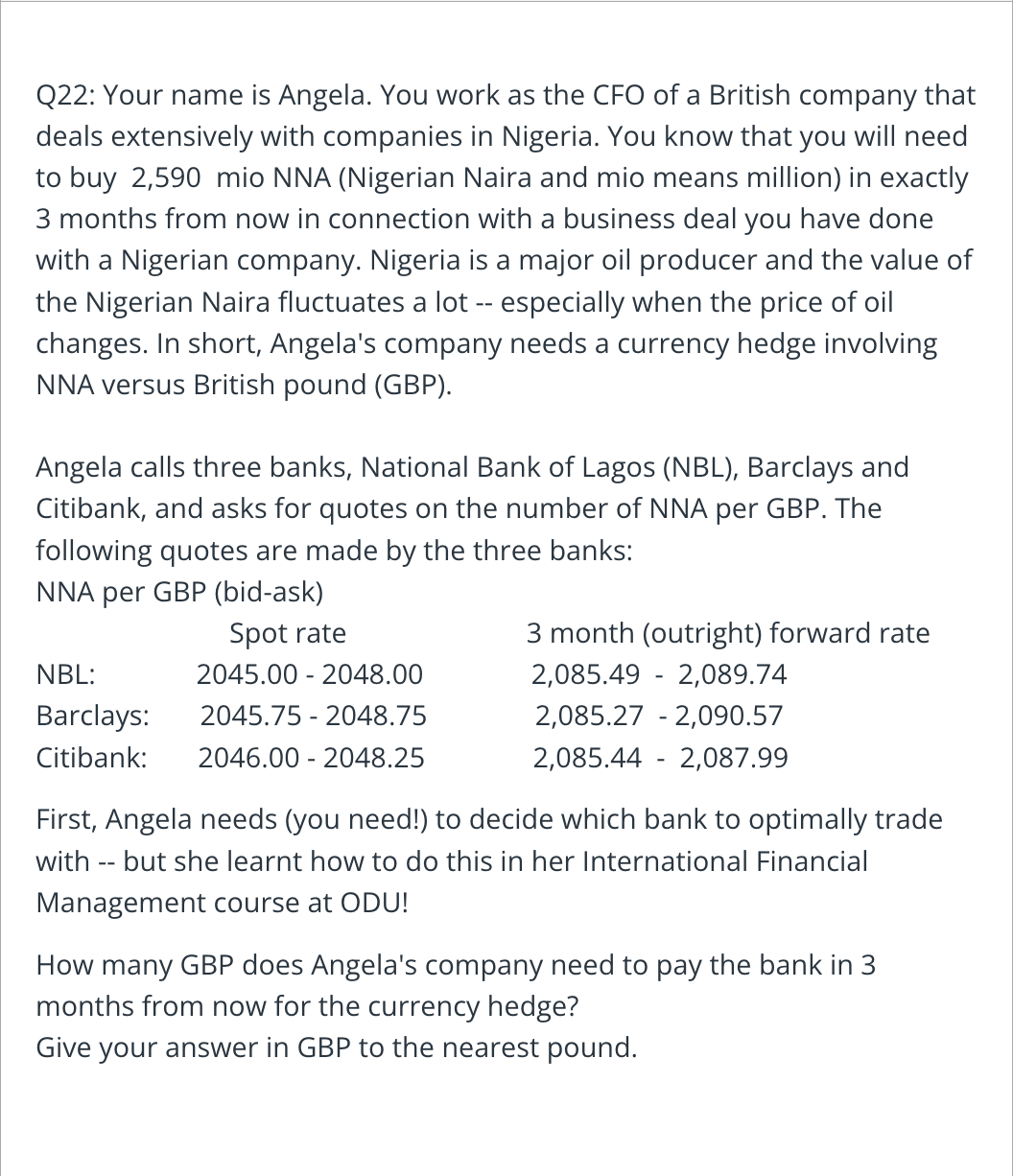

Q: Your name is Angela. You work as the CFO of a British company that deals extensively with companies in Nigeria. You know that you will need to buy mio NNA Nigerian Naira and mio means million in exactly months from now in connection with a business deal you have done with a Nigerian company. Nigeria is a major oil producer and the value of the Nigerian Naira fluctuates a lot especially when the price of oil changes. In short, Angela's company needs a currency hedge involving NNA versus British pound GBP

Angela calls three banks, National Bank of Lagos NBL Barclays and Citibank, and asks for quotes on the number of NNA per GBP The following quotes are made by the three banks:

NNA per GBP bidask

First, Angela needs you need! to decide which bank to optimally trade with but she learnt how to do this in her International Financial Management course at ODU!

How many GBP does Angela's company need to pay the bank in months from now for the currency hedge?

Give your answer in GBP to the nearest pound.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock