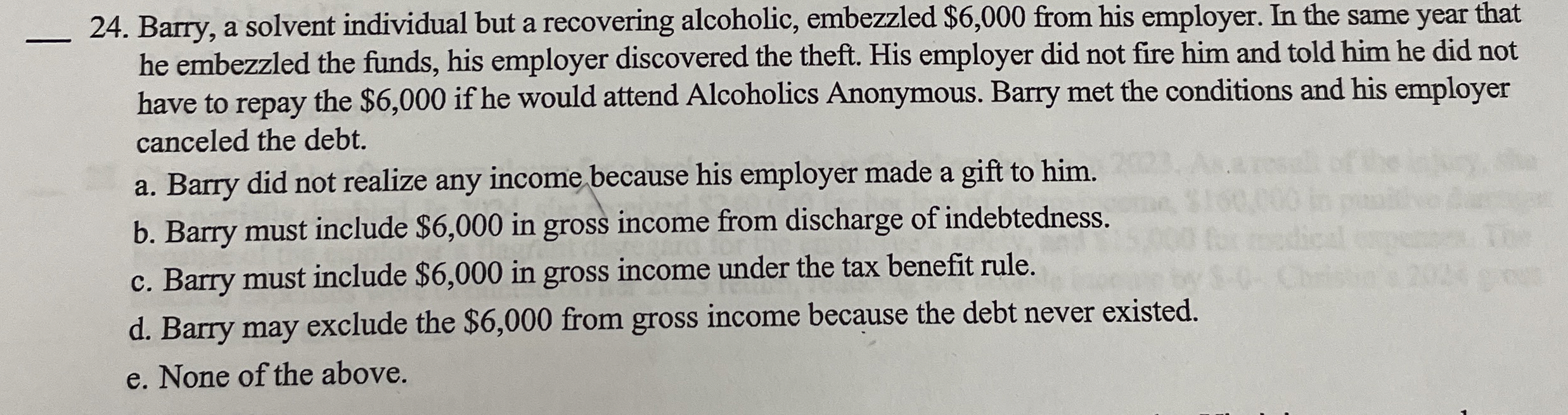

Question: q , 2 4 . Barry, a solvent individual but a recovering alcoholic, embezzled $ 6 , 0 0 0 from his employer. In the

Barry, a solvent individual but a recovering alcoholic, embezzled $ from his employer. In the same year that he embezzled the funds, his employer discovered the theft. His employer did not fire him and told him he did not have to repay the $ if he would attend Alcoholics Anonymous. Barry met the conditions and his employer canceled the debt.

a Barry did not realize any income because his employer made a gift to him.

b Barry must include $ in gross income from discharge of indebtedness.

c Barry must include $ in gross income under the tax benefit rule.

d Barry may exclude the $ from gross income because the debt never existed.

e None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock