Question: Q 2 . ( 7 points ) In 1 9 9 1 Argentina pegged its peso to the U . S . dollar at one

Q points

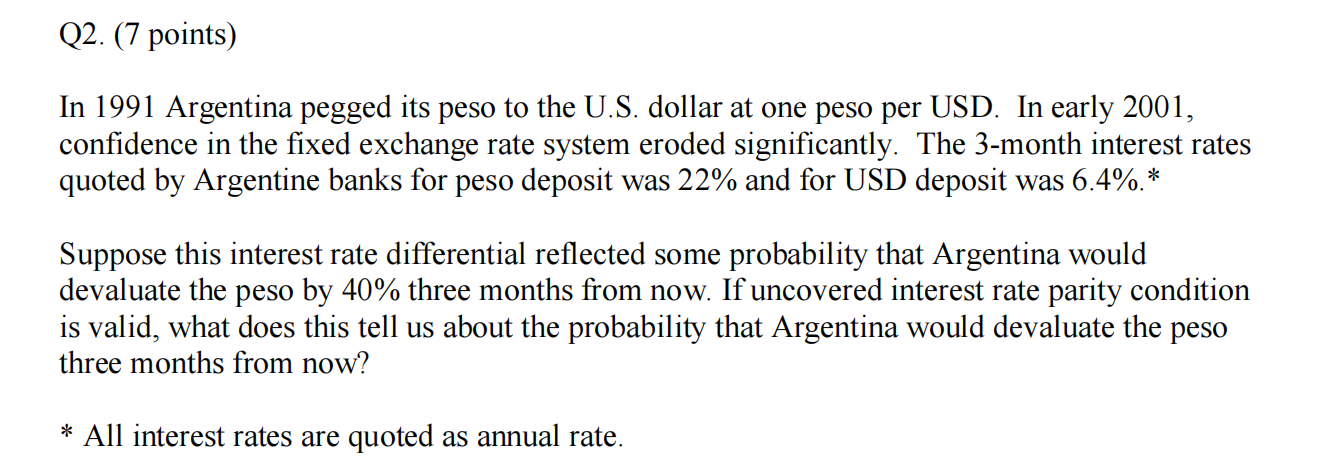

In Argentina pegged its peso to the US dollar at one peso per USD. In early confidence in the fixed exchange rate system eroded significantly. The month interest rates quoted by Argentine banks for peso deposit was and for USD deposit was

Suppose this interest rate differential reflected some probability that Argentina would devaluate the peso by three months from now. If uncovered interest rate parity condition is valid, what does this tell us about the probability that Argentina would devaluate the peso three months from now?

All interest rates are quoted as annual rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock