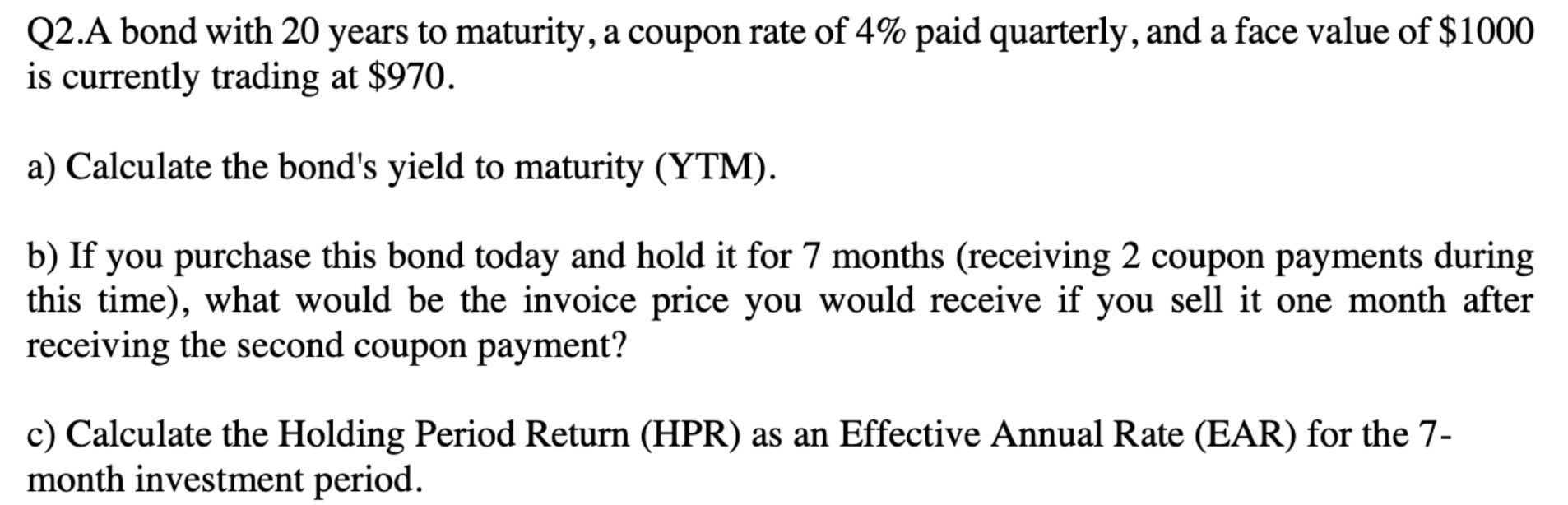

Question: Q 2 . A bond with 2 0 years to maturity, a coupon rate of ( 4 % ) paid quarterly, and

QA bond with years to maturity, a coupon rate of paid quarterly, and a face value of $ is currently trading at $ a Calculate the bond's yield to maturity YTM b If you purchase this bond today and hold it for months receiving coupon payments during this time what would be the invoice price you would receive if you sell it one month after receiving the second coupon payment? c Calculate the Holding Period Return HPR as an Effective Annual Rate EAR for the month investment period.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock