Question: Q 2 and 3 coefficient between returns on Microsoft stock and returns on the S&P 500 index is 0.8 You also estimated that the expected

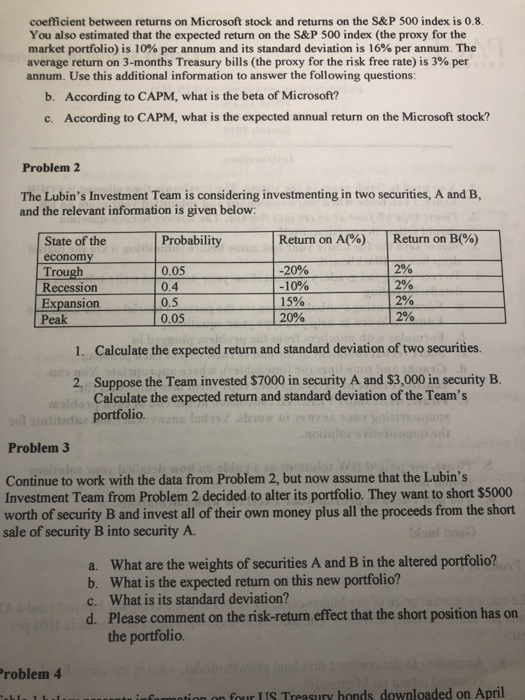

coefficient between returns on Microsoft stock and returns on the S&P 500 index is 0.8 You also estimated that the expected return on the S&P 500 index (the proxy for the market portfolio) is 10% per annum and its standard deviation is 16% per annum. The average return on 3-months Treasury bills (the proxy for the risk free rate) is 3% per annum. Use this additional information to answer the following questions: According to CAPM, what is the beta of Microsoft? According to CAPM, what is the expected annual return on the Microsoft stock? b. c. Problem 2 The Lubin's Investment Team is considering investmenting in two securities, A and B, and the relevant information is given below State of the Probability Return on A(06) | Return on B(%) econom 0.05 0.4 0.5 0.05 -20% -10% 15% 20% 12% 2% 2% 2% Troug Recession Expansion Peak 1. Calculate the expected return and standard deviation of two securities. 2. Suppose the Team invested $7000 in security A and $3,000 in securityB. Calculate the expected return and standard deviation of the Team's portfolio Problem3 Continue to work with the data from Problem 2, but now assume that the Lubin's Investment Team from Problem 2 decided to alter its portfolio. They want to short $5000 worth of security B and invest all of their own money plus all the proceeds from the short sale of security B into security A a. b. c. d. What are the weights of securities A and B in the altered portfolio? What is the expected return on this new portfolio? What is its standard deviation? Please comment on the risk-return effect that the short position has on the portfolio. roblem 4 r IIS Treasury honds. downloaded on April

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts