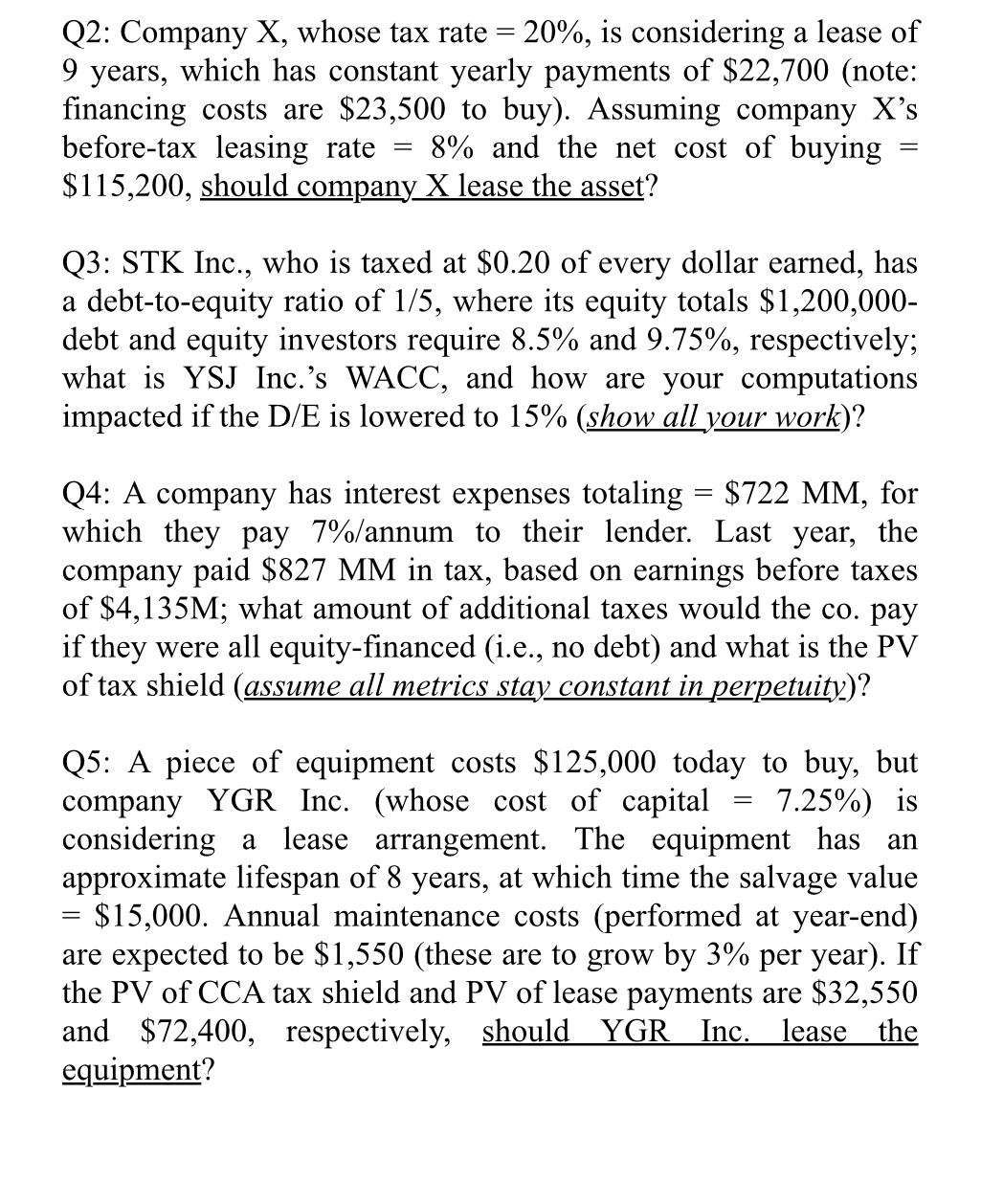

Question: Q 2 : Company X , whose tax rate = 2 0 % , is considering a lease of 9 years, which has constant yearly

Q: Company X whose tax rate is considering a lease of years, which has constant yearly payments of $note: financing costs are $ to buy Assuming company Xs beforetax leasing rate and the net cost of buying $ should company X lease the asset?

Q: STK Inc., who is taxed at $ of every dollar earned, has a debttoequity ratio of where its equity totals $ debt and equity investors require and respectively; what is YSJ Inc.s WACC, and how are your computations impacted if the DE is lowered to show all your work

Q: A company has interest expenses totaling $ for which they pay annum to their lender. Last year, the company paid $ MM in tax, based on earnings before taxes of $; what amount of additional taxes would the co pay if they were all equityfinanced ie no debt and what is the PV of tax shield assume all metrics stay constant in perpetuity

Q: A piece of equipment costs $ today to buy, but company YGR Inc. whose cost of capital is considering a lease arrangement. The equipment has an approximate lifespan of years, at which time the salvage value $ Annual maintenance costs performed at yearend are expected to be $these are to grow by per year If the PV of CCA tax shield and PV of lease payments are $ and $ respectively, should YGR Inc. lease the equipment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock