Question: Q 2 . Jameson is a 3 2 - year - old father of three who thought he had finally found a career. While working

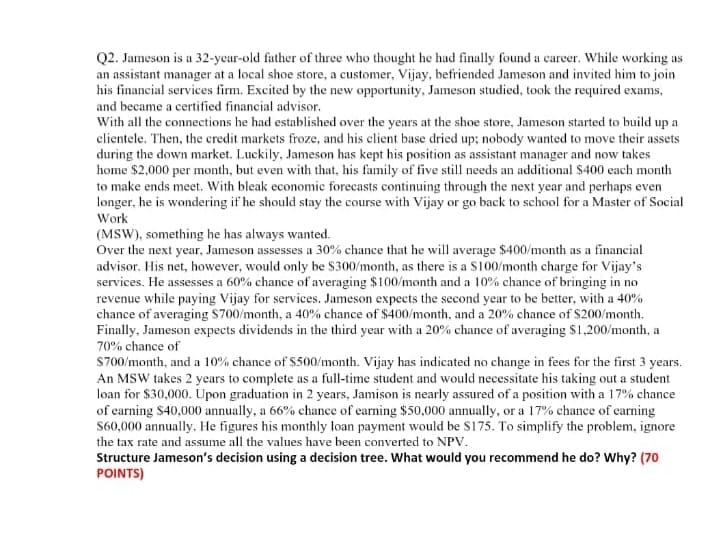

Q Jameson is a yearold father of three who thought he had finally found a career. While working as an assistant manager at a local shoe store, a customer, Vijay, befriended Jameson and invited him to join his financial services firm. Excited by the new opportunity, Jameson studied, took the required exims, and became a certified financial advisor.

With all the connections he had established over the years at the shoe store, Jameson started to build up a elientele. Then, the credit markets froze, and his client base dried up; nobody wanted to move their assets during the down market. Luckily, Jameson has kept his position as assistant manager and now takes home $ per month, but even with that, his fanily of five still needs an additional $ each month to make ends meet. With bleak economic forecasts continuing through the next year and perhaps even longer, he is wondering if he should stay the course with Vijay or go back to school for a Master of Social Work

MSW something he has always wanted.

Over the next year, Jameson assesses a chance that he will average $ month as a financial advisor. His net, however, would only be $ month, as there is a $onth charge for Vijay's services. He assesses a chance of averaging $ month and a chance of bringing in no revenue while paying Vijay for services. Jameson expects the second year to be better, with a chance of averaging $ month, a chance of $ month, and a chance of $ month. Finally, Jameson expects dividends in the third year with a chance of averaging $onth, a chance of

$ month, and a chance of $ month. Vijay has indicated no change in fees for the first years. An MSW takes years to complete as a fulltime student and would necessitate his taking out a student loan for $ Upon graduation in years, Jamison is nearly assured of a position with a chance of earning $ annually, a chance of earning $ annually, or a chance of carning $ annually. He figures his monthly loan payment would be $ To simplify the problem, ignore the tax rate and assume all the values have been converted to NPV

Structure Jameson's decision using a decision tree. What would you recommend he do Why? POINTS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock