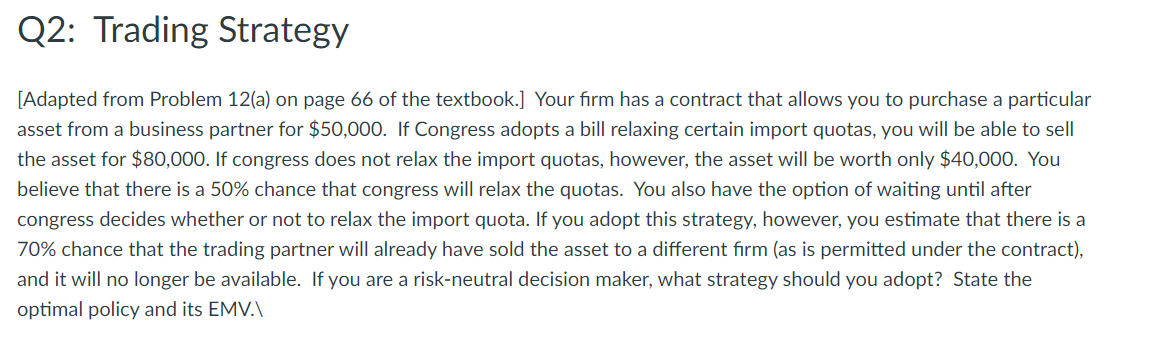

Question: Q 2 : Trading Strategy [ Adapted from Problem 1 2 ( a ) on page 6 6 of the textbook. ] Your firm has

Q: Trading Strategy

Adapted from Problem a on page of the textbook. Your firm has a contract that allows you to purchase a particular

asset from a business partner for $ If Congress adopts a bill relaxing certain import quotas, you will be able to sell

the asset for $ If congress does not relax the import quotas, however, the asset will be worth only $ You

believe that there is a chance that congress will relax the quotas. You also have the option of waiting until after

congress decides whether or not to relax the import quota. If you adopt this strategy, however, you estimate that there is a

chance that the trading partner will already have sold the asset to a different firm as is permitted under the contract

and it will no longer be available. If you are a riskneutral decision maker, what strategy should you adopt? State the

optimal policy and its EMV. DRAW A DECISION TREE AS WELL.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock