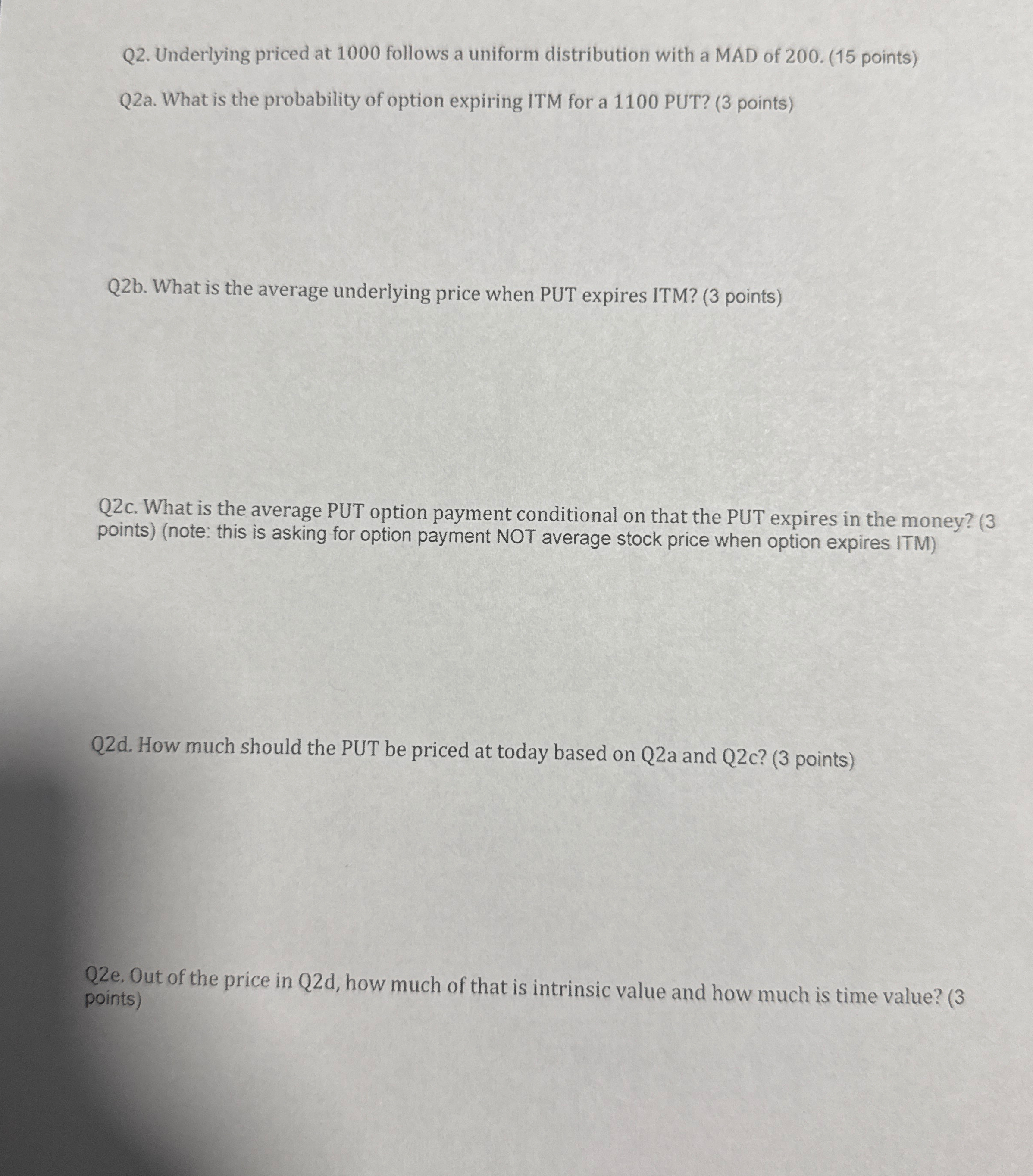

Question: Q 2 . Underlying priced at 1 0 0 0 follows a uniform distribution with a MAD of 2 0 0 . ( 1 5

Q Underlying priced at follows a uniform distribution with a MAD of points

Qa What is the probability of option expiring ITM for a PUT? points

Qb What is the average underlying price when PUT expires ITM? points

Qc What is the average PUT option payment conditional on that the PUT expires in the money?

pointsnote: this is asking for option payment NOT average stock price when option expires ITM

Qd How much should the PUT be priced at today based on Qa and Qc points

Qe Out of the price in Qd how much of that is intrinsic value and how much is time value?

points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock