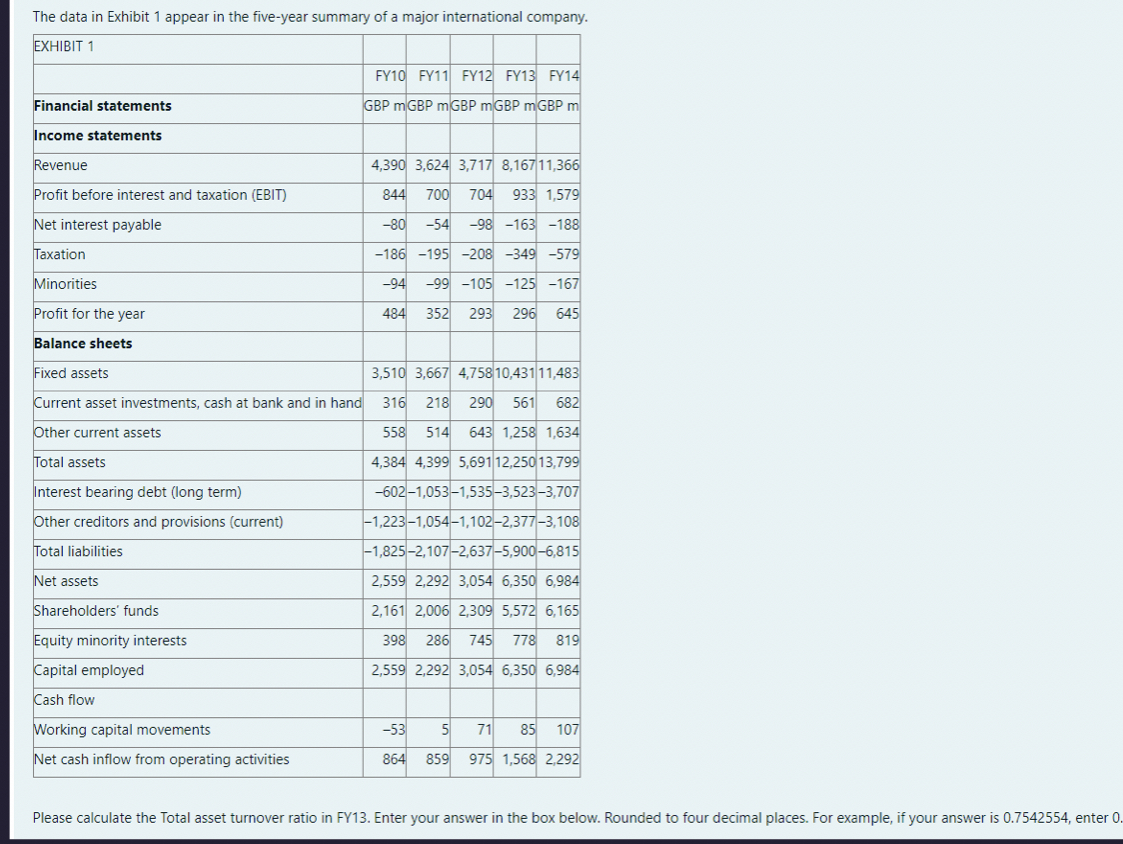

Question: Q = 2 Using the information in Exhibit 1 from Question 2 , please calculate the Current Ratio in FY 1 3 . Enter your

Q Using the information in Exhibit from Question please calculate the Current Ratio in FY Enter your answer in the box below. Rounded to four decimal places. For example, if your answer is enter edd out ofAnswer:Q Using the information in Exhibit from Question please calculate the debttoassets ratio in FY Note that in this course, we define debt as the longterm interesting bearing defot. Enter your answer in the box below. Rounded to four decimal places.For example, if your answer is enter Answer:QUsing the information in Exhibit from Question please calculate the Interest coverage ratio in FY Enter your answer in the box below. Rounded to two decimal places. For example, if your answer is enter QUsing the information in Exhibit from Question please calculate the Profit Margin in FY Enter your answer in the box below. Rounded to four decimal places. For example, if your answer is enter Answer:Q: Based on your answer in Question answer if the following aspects of the firm improved or deteriorated from FY to FYAnswer improved, deteriorated or remained unchangedProfitabilityAns:EfficiencyAns;LiquidityAnd:SolvencyAns:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock