Question: Q# 2 . You are preparing to discuss borrowing needs with your bank's loan officer who asks you to prepare pro - forma financial statements.

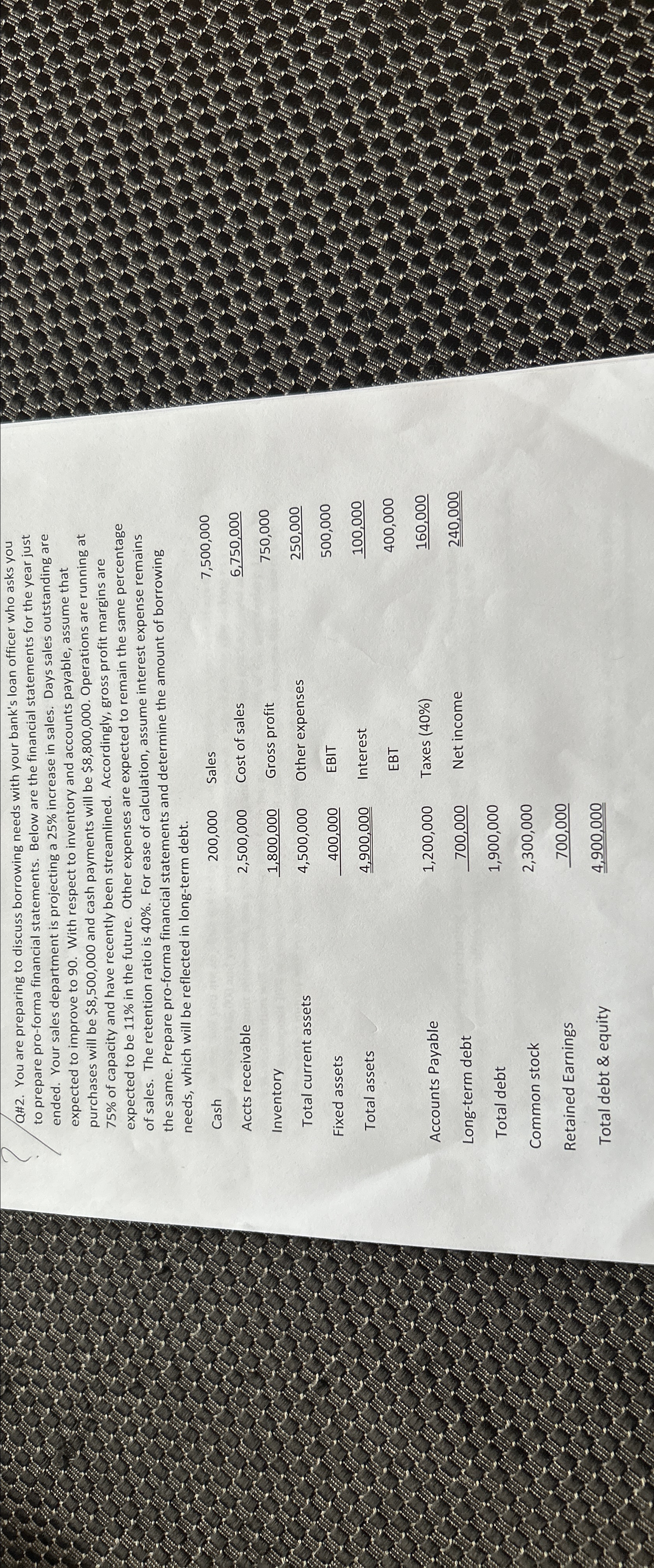

Q# You are preparing to discuss borrowing needs with your bank's loan officer who asks you to prepare proforma financial statements. Below are the financial statements for the year just ended. Your sales department is projecting a increase in sales. Days sales outstanding are expected to improve to With respect to inventory and accounts payable, assume that purchases will be $ and cash payments will be $ Operations are running at of capacity and have recently been streamlined. Accordingly, gross profit margins are expected to be in the future. Other expenses are expected to remain the same percentage of sales. The retention ratio is For ease of calculation, assume interest expense remains the same. Prepare proforma financial statements and determine the amount of borrowing needs, which will be reflected in longterm debt.

tableCashSales,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock