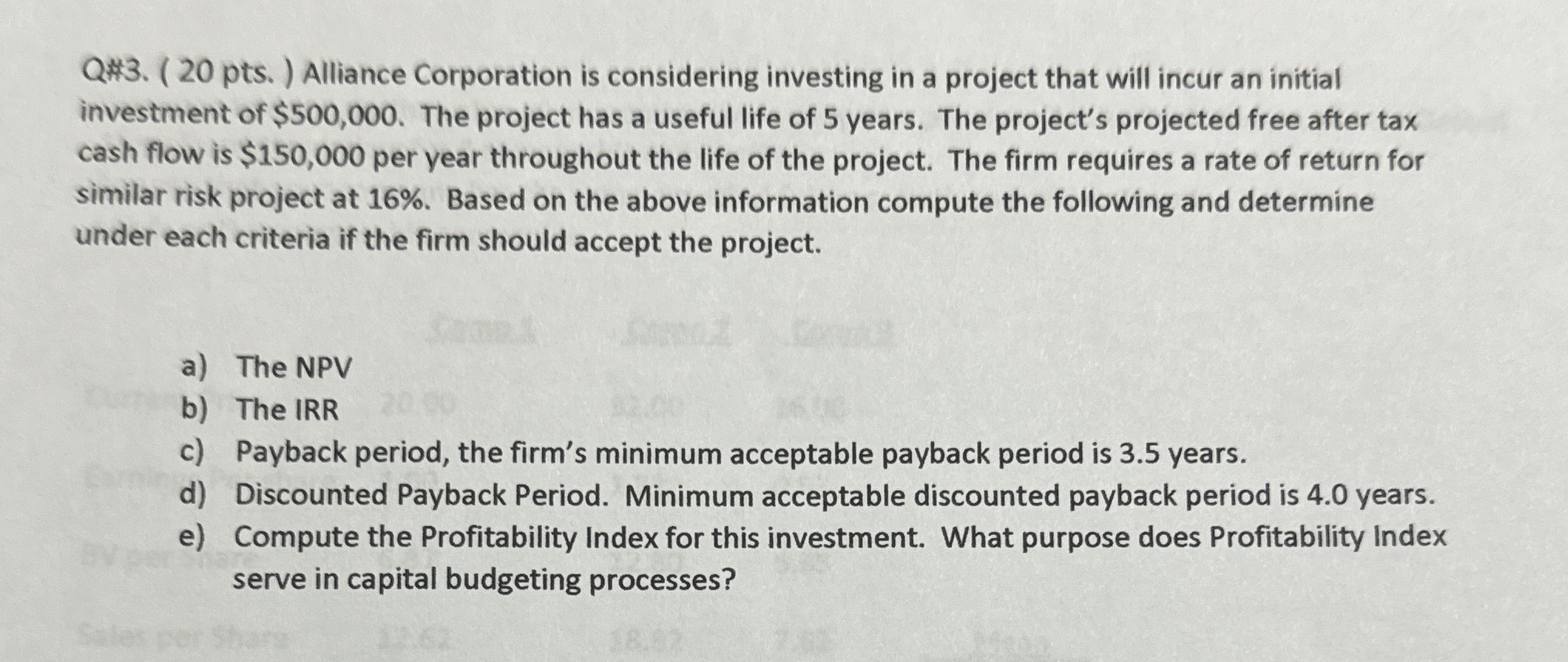

Question: Q# 3 . ( 2 0 pts . ) Alliance Corporation is considering investing in a project that will incur an initial investment of $

Q# pts Alliance Corporation is considering investing in a project that will incur an initial investment of $ The project has a useful life of years. The project's projected free after tax cash flow is $ per year throughout the life of the project. The firm requires a rate of return for similar risk project at Based on the above information compute the following and determine under each criteria if the firm should accept the project solve and show answers

a The NPV

b The IRR

c Payback period, the firm's minimum acceptable payback period is years.

d Discounted Payback Period. Minimum acceptable discounted payback period is years.

e Compute the Profitability Index for this investment. What purpose does Profitability Index serve in capital budgeting processes?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock