Question: Q 3 ( a ) CJ Industries will pay a regular dividend of RM 3 . 5 0 per share for each of the next

Q

a CJ Industries will pay a regular dividend of RM per share for each of the

next three years. At the end of the three years, the company will also pay out a

RM per share liquidating dividend, and the company will cease operations. If

the discount rate is percent, calculate the today value of the company's stock.

marks

b Apple Grove, Inc., will pay dividends for the next years. The expected

dividend growth rate for this firm is percent, the discount rate is percent,

and the stock currently sells for RM per share. Show the most recent dividend

payment.

marks

c Suppose the Titanic Ice Cube Cos dividend grows at a percent rate for the

next three years. Thereafter, it grows at a percent rate. Titanic's most recent

dividend was RM Compute the value of the Titanic stock assuming a

percent discount rate.

marks

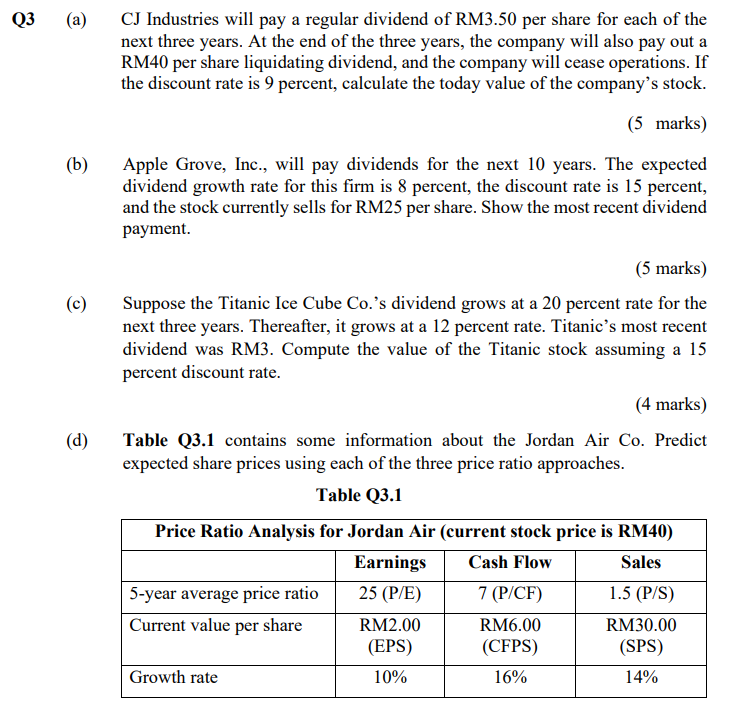

d Table Q contains some information about the Jordan Air Co Predict

expected share prices using each of the three price ratio approaches.

Table Q

Please give me a detailed step by step solution for all the subquestions. PLease answer it all. Strictly don't use softwares to find the solution. You may use software to justify your answers but please show me manual workings. Make sure the formula used is correct and the answer is correct too. I will upvote for you if you can solve for me within hours.Thankyou

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock