Question: ( Q 3 B ) The table below provides the correlations between Green, a telephone / communication company located in Mexico, the Mexico stock market

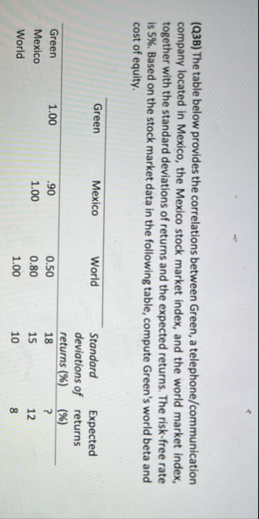

QB The table below provides the correlations between Green, a telephonecommunication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations of returns and the expected returns. The riskfree rate is Based on the stock market data in the following table, compute Green's world beta and cost of equity.

tableGreen,Mexico,World,tableStandarddeviations ofreturns tableExpectedreturns

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock